For the greater part of 2012, the Swiss National Bank (SNB) ensured that the Swiss Franc was never strengthened beyond its acceptable exchange rate of 1.20 against the Euro. So far, EURCHF has therefore been trading within a fairly tight range of between 1.20 and 1.26 this year.

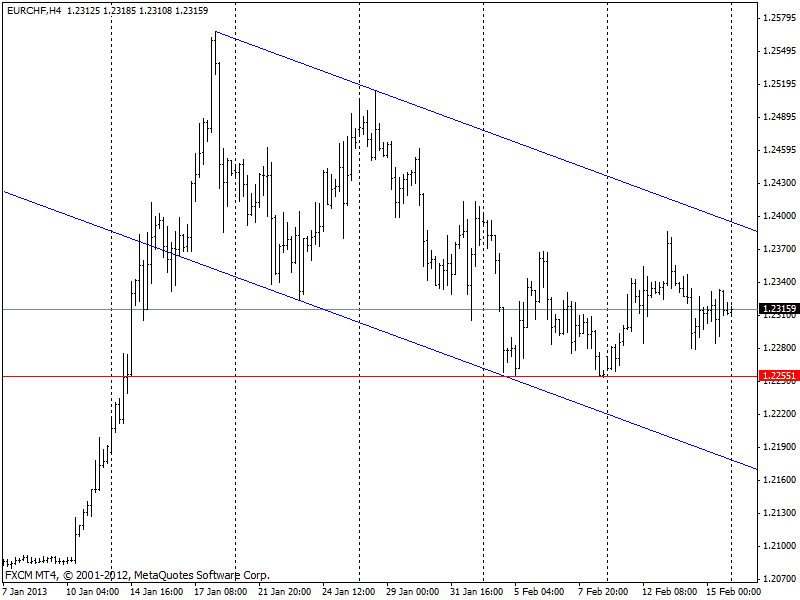

For the week 11 – 15 February, EUR/CHF continued to travel in a channel range between a high of 1.2568 and a low of 1.2255 with a possible re-test of the low this week.

A break below this level will open the door to a fresh low towards the channel support towards the 1.21 area. Indicator readings on the daily time-frame are still bearish while shorter time-frames are mixed.

Last week, a board member of the SNB, Fritz Zurbruegg expressly stated that the Swiss Franc is still very strong. He also said that the lingering uncertainty regarding the EU’s economic situation makes it very necessary for the SNB to maintain the currency pair’s base limit at 1.20. In a published interview with a Swiss Newspaper reported via Reuters, Zurbruegg was quoted thus, “The Swiss franc is overvalued even at today’s exchange rate against the euro.” “The minimum exchange rate remains the appropriate instrument for the foreseeable future to ensure price stability.”

Other highlights of the interview reports are that the Franc is still overvalued and that the SNB is on alert to implement more measures if the need arises. However, he says EURCHF is well above the intervention level which means position traders can take safe highs and lows for the short term.

Based on the chart below, allow price to rebound from the upper channel to go short towards the 1.2255. A downward break of this level should move stops to breakeven and extend profit-taking to the lower end of the channel.

However, a breakout of the upper channel should be followed with a long position, aiming for the last high of 1.2565.