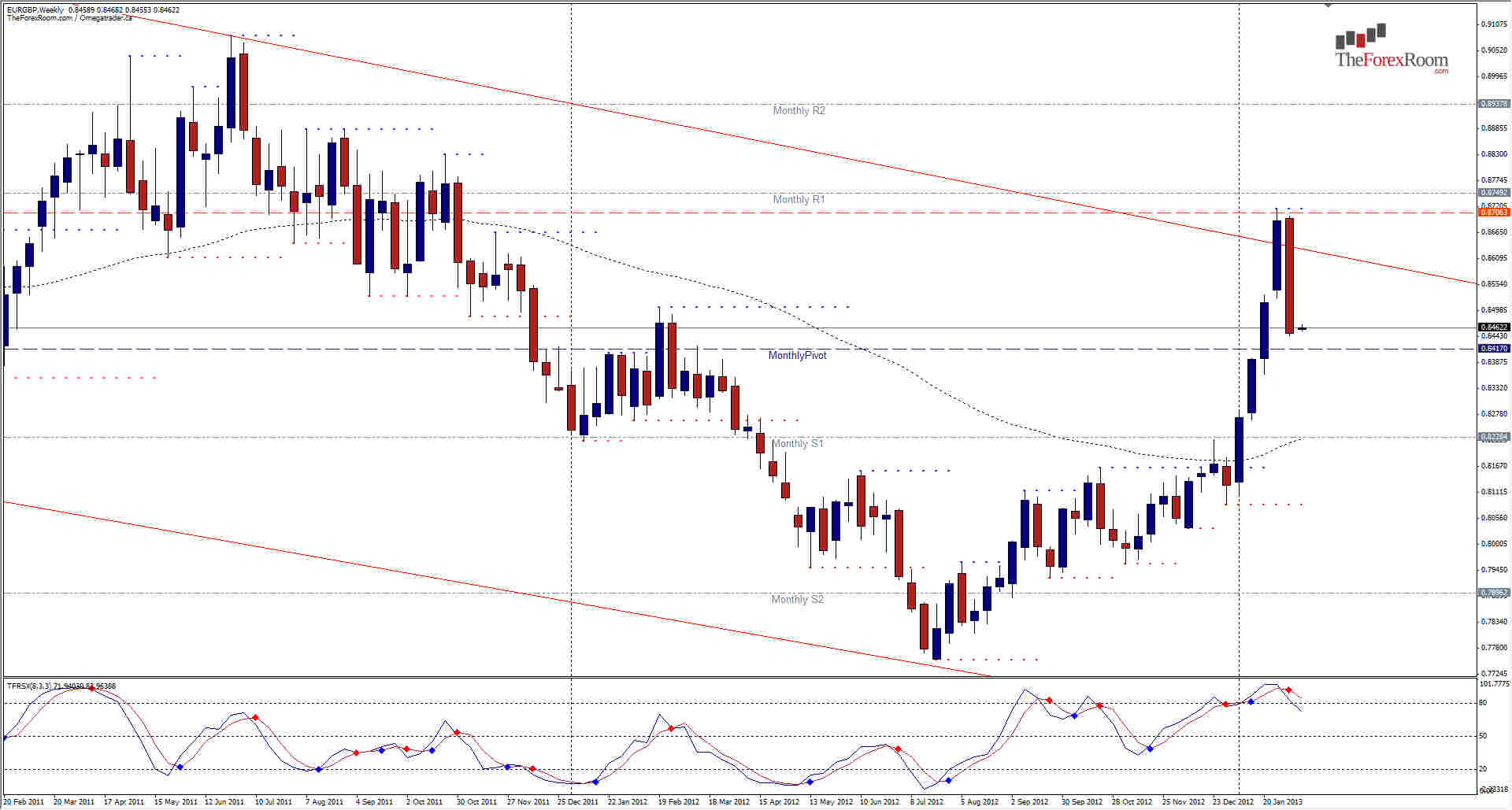

The EUR/GBP reversed in a big way last week after hitting the resistance level at 0.8700. The pair fell 250 pips from the open at 0.8696, in the last 3 days of last week's trading to close at 0.8446. Closing just shy of a support level of 0.8417, where the pair was held in place for 13 of 15 weeks between November 12, 2011 and April 2012 when the pair broke out to the downside and headed for the 2012 low at 0.7754 several weeks later. Now, the Monthly Pivot sits at 0.8417 and it is very fitting considering this level really is a pivot for the pair. Last month the pair printed a massive bullish candle, but was unable to break the monthly descending trend-line at 0.8640. Will the bears stay in control now, and ride the wave back down to the 0.8100 area, or even the 0.7700's? It certainly makes an argument for selling, along with an oversold signal on the Stochastic, but be wary of the bigger picture and take note that key support levels are waiting at 0.8362, 0.8225 (Combined Monthly R1 & 62EMA), plus the Weekly S3 and highs from April 2008 through October 2008. On the bullish front they will now need to clear the 0.8700 area before any forecasts will be valid, but if they can the most likely target will be the 0.9000 area after facing resistance at 0.8531, 0.8749 & 0.8870.

EUR/GBP Reverses - Feb. 11, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/GBP