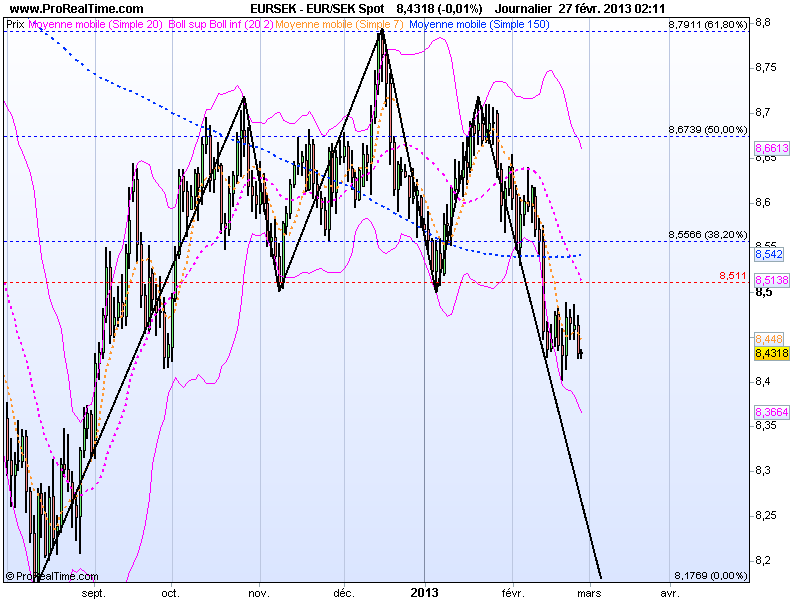

For a few sessions the EUR/SEK pair had consolidated in a relatively tight trading range. The medium term bearish situation pushes us to consider an exit of the figure from the bottom as we still have the presence of the figure Shoulder -head-Shoulder spotted on the 61.8% Fibonacci level. The moving average at 7 sessions should also be a dynamic resistance and push prices down.

Direction: Sell

Entry: 8.4320

Stop-loss: 8.52

Take-Profit: 8.20