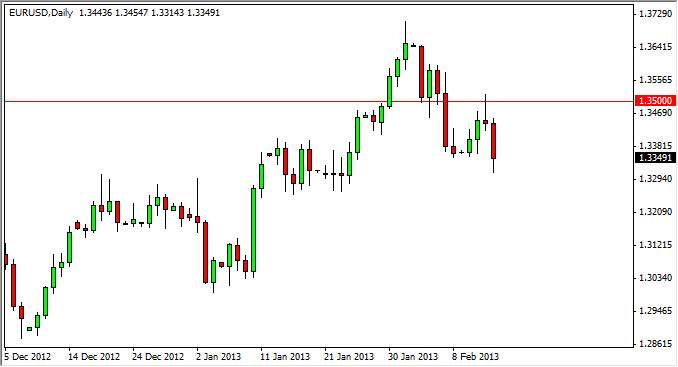

The EUR/USD pair fell rather significantly during the Thursday session, as foretold by the shooting star on Wednesday. However, I have to admit that I did not take this trade as I didn't see much room for the markets to move. Simply put, I see far too much noise below to be involved in selling the Euro right now. I believe that there is a reason why this pair started going higher, and although I recognize that 1.35 is resistive, I don't know that it will hold forever.

Looking at this chart, I can see that the 1.33, the 1.32, and the 1.30 levels all look very supportive. Because of this, I think it's simply going to be easier to wait until we get some type of supportive candle to start buying again. After all, most of this reaction has been a knee-jerk reaction to a few choice words out of the ECB, and not anything to do with reality. It's as almost as if the entire world has forgotten that the Federal Reserve plans on devaluing the US dollar going forward. Simply put, the Europeans are absolute amateurs when it comes to destroying their own currency, and are way out of their league fighting the Fed at this.

Patience

In order to take this type of trade, you have to be very patient. I believe that the longer-term trend will prove me to be correct in the long run, and as a result I am very willing to accept the fact that I may have to be on the sidelines for a while. However, I think that a move above the shooting star on Wednesday would be enough to get me going long again. I also believe that a pullback to the 1.30 level would be magnificent as well as it allows me to buy the Euro cheaply. I look at this is a long-term trade, and as a result I want to buy the Euro when it's "on sale." Looking at the chart right now, it appears that the sale is about to begin.