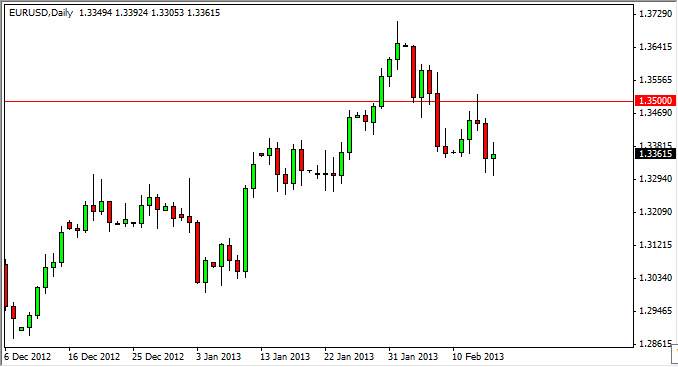

The EUR/USD pair had a fairly quiet session on Friday as the markets in general went back and forth. It seems that most traders simply were not interested in taking a lot of risk in the marketplace going into the weekend, as is often the case on a Friday. However, we can see that this market has sold off over the last couple of sessions in general, as the 1.35 level seems to be far too resistive at the moment.

This of course is exacerbated by the European Central Bank talking the value of the Euro down, and that the inflated price is starting to hurt the export market. Because of this, traders have been very skittish when it comes to owning the Euro, and as a result we have seen general weakness in this market.

However, when you look at this chart you can see that the decline hasn't necessarily been very steep. It is because of this that I believe this market will continue to go higher over the longer term. This is a pullback, and that's a good thing for those who would wish to own the Euro for the longer-term type of trade.

Several levels of support

The biggest problem I see with shorting this pair right now is the fact that there are several levels below that could be supportive. The first place that comes to mind is the 1.33 level that acted as support on Friday, followed by the 1.32 level and of course the 1.30 level. The 1.30 level is what I would consider to be the "floor" in this market right now as it is the largest round number in the vicinity.

The shape of the candle on Friday shows the indecision, and you can see quite a bit of noise between here and 1.32. In fact, I would be surprised to see this market go sideways rather than down. The next couple of sessions will be very important for the next couple of hundred pips, but in the long run I am still looking to buy supportive candles long as we can stay above the 1.30 level.