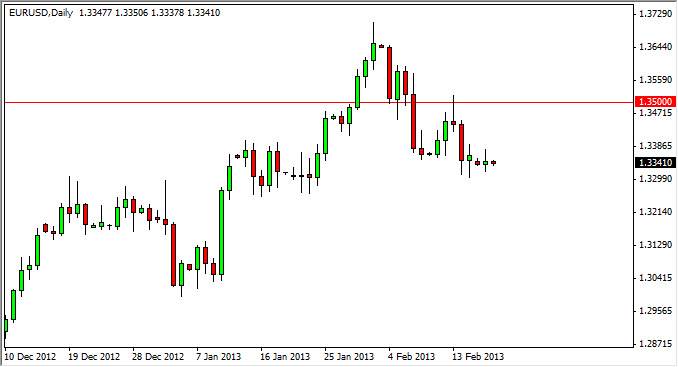

The EUR/USD pair did very little on Monday, but the Americans were away celebrating President’s Day. The largest players in New York were certainly away, and as a result there is only so much that can be read into the price action. With this in mind, the markets did look like it found a bit of support in the 1.3350 area. This session suggested that the noisy area under the current price level could give the sellers some problems, and the fact that we simply could go sideways must enter the conversation as well.

The 1.33 level below should continue to offer support, and the pair also has quite a bit of minor areas below. The 1.30 level is a major support area, and as such I believe that the pair will only fall so far at this point. After all, a lot of the selloff comes down to the belief that the Europeans might do something to devalue their currency, something that looks very unlikely considering the Germans are steadfast against it.

Also, it should be noted that the G20 failed to call out the Japanese and their easing. (No surprise there at all.) The fact that Mario Draghi has since suggested there isn’t some kind of currency war, signaling the fact that he is either lost, or simply isn’t ready to fight it. Because of this, I believe the markets have given the ECB far too much credit as to their ability to fight the Federal Reserve in a “race to the bottom.”

To lose is to win

It appears that the central banks around the world are trying to lose as much value to their currencies as possible. The idea is that it makes your exports cheaper and more competitive in other markets, generating larger amounts of GDP. However, this is a game that someone has to lose, and most people that have any amount of experience knows that it isn’t wise to fight the Fed. Because of this, I believe that we will continue higher over the long-term, and as a result I am buying supportive candles.