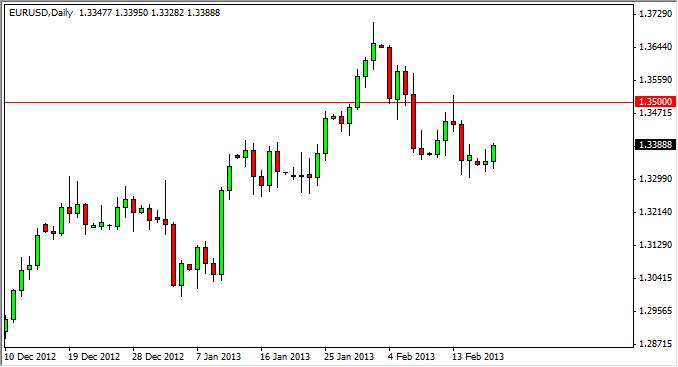

The EUR/USD market got a bit of a boost during the Tuesday session as the ZEW numbers in both Europe and Germany came out much stronger than expected. The ZEW is a measurement of confidence in the economy, and as a result the fact that the confidence level was much higher than anticipated got buyers in the mood the push the market higher.

This happened right at the 1.3350 area, which of course has been relatively supportive anyway. Because of this, it doesn't surprise me that we got a little bit of a bounce for the session, and I have been saying for some time that I believe the knee-jerk reaction that we got after the few comments by the ECB Chairman were a bit overdone. After all, the Europeans are mere amateurs when it comes to devaluing a currency, and in order to push this pair down much more they would have to be able to take on the Federal Reserve, the obvious masters.

Range bound

I believe that we are essentially going to see a bit of consolidation in this area going forward, and it will take some type of shock or headline to push the market neither direction. I believe that the Euro is going to continue to gain on the Dollar, and as a result would be more than willing to buy this market on a break above the shooting star from last week. This would be at roughly the 1.3520 level, as it would show that the resistance has been broken through yet again.

Don't forget there is a larger inverted head and shoulders that we essentially triggered last week, and a little bit of a pullback doesn't necessarily negate that technical analysis. That inverted head and shoulders suggested that the market was going to hit the 1.50 level eventually, and I still think it's very possible. As long as the Federal Reserve is willing to devalue the US dollar, a move to the 1.50 level certainly can be ruled out. Remember, the Europeans have to get a lease 17 members together to do something drastic, of the Federal Reserve only has to hit the print button on their printers.