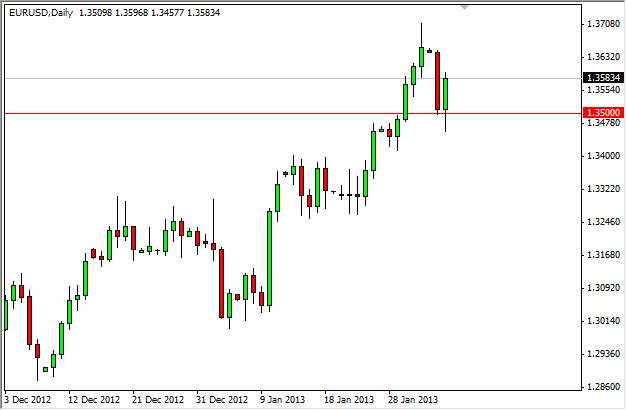

The EUR/USD pair initially fell during the session on Tuesday, as it broke down through the 1.35 level. This area represented a significant support zone as far as I could tell, so I was glad to see that the market popped back over that level and close significantly higher. In fact, we managed to not only managed to hang on to the support at 1.35, as I write this within an hour of the daily close, we are roughly 80 pips above it.

Looking at the shape of the candle, it is somewhat of a hammer, and as a result it suggests that we are going to see strength. With this being said, I do believe that Euro will continue to appreciate in value against the Dollar. Also, it should be stated that unlike many of the other currency moves right now, this point is a steady and maintainable ascension. This means that this rally is much healthier and more than likely will contain longer-term buyers.

1.37

For me, the 1.37 level is the next major hurdle to overcome. Looking at the longer-term charts, I have of course been talking about the inverted head and shoulders that we've recently broken out. In fact, the last 48 hours has seen the market retest that area that was considered to be the neckline, and it has held true. Because of this, I do believe that we will eventually see the 1.4950 handle, so although I expect 1.37 to put up a fight, I do believe that eventually we will blow through it.

That being said, I believe that every time this pair pulls back over the next few weeks will be an opportunity to build huge long positions. In fact, that's exactly what I'm doing right now. By building a core position, I am open to take advantage of a long-term move higher. There were fortunes made five and six years ago during the last steady uptrend in this pair, and I'm hoping that we are heading into a time period much like that one was.