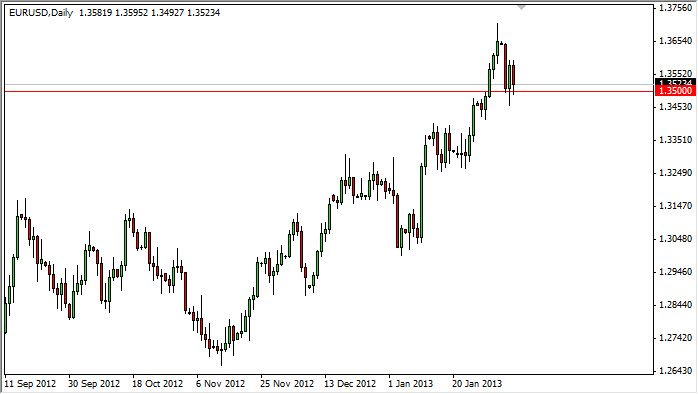

The EUR/USD pair fell during the session on Wednesday, but as has been the case over the last three days, the 1.35 level has offered support. Currently, I feel that this pair is waiting to find out what the folks at the European Central Bank have to say later today, and whether or not they make any suggestion that the euro being priced at 1.35 offers problems. Ultimately, I don't think the market cares with the ECB things, as the Federal Reserve can certainly out printed. With that being said though, there is risk of a sharp knee-jerk reaction if the right words are uttered.

However, the Germans have already suggested that they are fine with current pricing, and as such the three possible that the ECB press conference can be a nonevent. If that's the case, I feel that traders will feel confident enough to begin to start buying again. After all, we've broken a fairly significant barrier in the form of 1.35 on the longer-term charts, and I fully expect that to be in the minds of most currency traders out there.

Inverted head and shoulders

As you know, I have been talking about an inverted head and shoulders that has formed in this pair, with the neckline 1.35 being broken last week. This is of vital turn of events in this pair, and because of that I think that we will eventually hit 1.4950 by the time this move is done. This doesn't mean that the move will be easy or straightforward, as it never is and the Forex markets. However, the trend is most certainly up in the Euro, and as a result I can only buy this pair going forward. In fact, I believe that there is a ton of support below, going all the way down to the 1.3350 level.

Even if the ECB utters something about the Euro being too high, it's only a matter of time before the market turns around and runs it back up. After all, all you have to do is look at the last couple of months to see what the market thinks about the Euro in general. That being said, I will not be selling, and will more than likely either add to my position on a gap, or even a breakout above the highest from both Tuesday and Wednesday.