The GBP/CHF pair has completely fallen apart over the last several sessions. The Friday session was just another collapse in a long running fall. This pair is a bit like the GBP/USD pair, but on steroids. For those of you that don’t normally trade it, you should know that it is a lot less liquid than the GBP/USD pair, but does tend to move in the same direction.

Over the last couple of years, the Swiss National Bank has been buying this pair. This is a way for them to diversify their holdings, and as a result the Swiss can’t be happy at all. This pair is rapidly working against them, but there is little that can be done at the moment. After all, there are serious concerns of a “triple dip” recession in the UK, so the Pound will continue to be sold off.

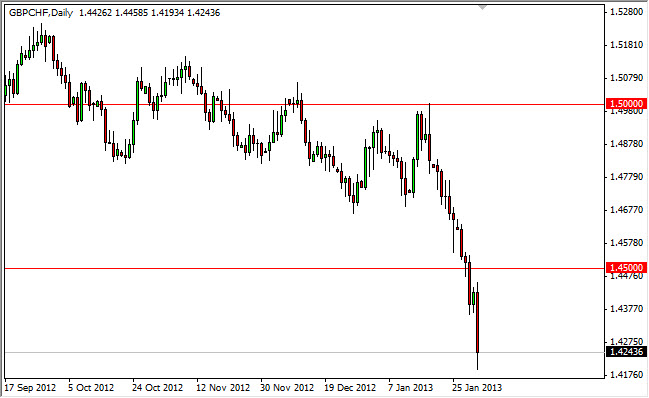

The 1.45 level giving way was just the next hurdle of the bears to overcome to break this market down. The truth is that they are on a roll, and the pain in the pain could just be starting. In the meantime, the Swiss may not be as concerned about this pair simply because the Euro is finally perking back up.

EUR/CHF

Ultimately, the Swiss are more worried about the Euro than anything else. This allows the GBP/CHF pair to fall in peace as long as the Euro can hang onto the bullish tone it has had recently. The pair certainly had fallen quite a bit lately, so a bounce isn’t too much to imagine at this point.

The 1.45 level should now be massively resistive though, and because of this I think this market will continue to offer bounces to sell, but not be able to get above there. The pair could really start to pick up steam if the GBP/USD continues to fall as well. This could be interesting as the CHF loses value against most other currencies but this one, making this pair a bit of an anomaly in the Forex markets. In the meantime, I will be shorting this pair based upon hourly charts for short-term trades going forward until we close above the 1.45 level on the daily chart.