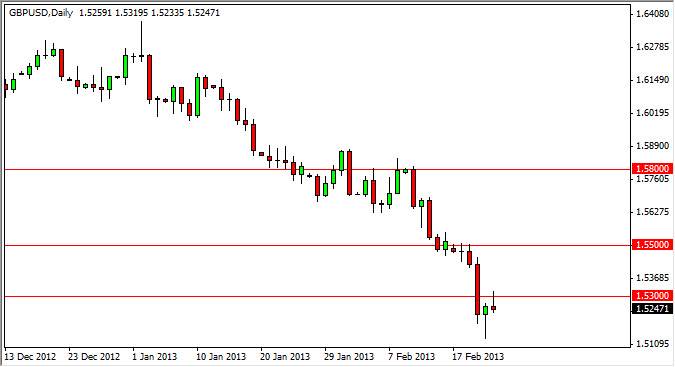

The GBP/USD pair rallied during the session on Friday, but gave back all of the gains once the pair got above the 1.53 level. The hammer that had printed on Thursday look like a pretty safe bet, but the fact that we couldn't gain on it’s really shows just how weak this pair is. On top of that, Moody's downgraded the credit rating of the United Kingdom after close of business on Friday. The markets have not had a chance to react to this yet, and that will be very interesting once the Asians get their hands on the Forex markets Monday morning.

The shooting star that was formed from the Friday session suggests that we are going to consolidate at the very least, if not flat-out breakdown. If we managed to break down from here, I believe that the 1.50 level will be tested as it is the next natural "big round number" that the market will be looking for. Also, it has historical relevance in this pair, as it has been both massive support and massive resistance at different times.

Confusion at the bank of England?

Adding insult to injury, Gov. King was in the minority of the latest monetary policy vote, which of course is very rare indeed. This shows that there is an undercurrent of dislocation in the Bank of England, and as a result we think that it's and a very poor sign to the market.

I also believe that this market will more than likely have a significant selloff going forward as the full weakness of the United Kingdom's economy shows itself. After all, the economic numbers out of London haven't exactly been great, while the United States seems to be doing much better at this moment in time. There is going to be the measure of quantitative easing out of United States, but in reality the situation in the United Kingdom flat-out demands rate cuts according to many of the voting members at the Bank of England. If that's the case, the Pound will continue to be pummeled going forward. I will sell rallies every time they happen.