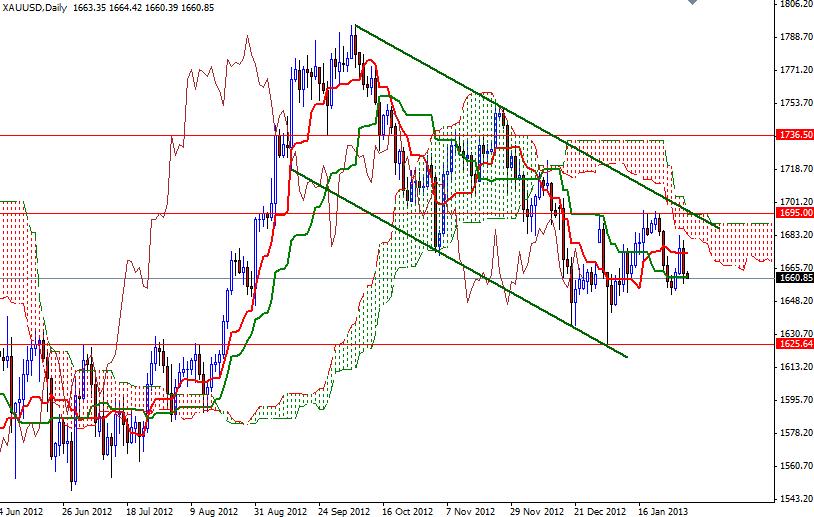

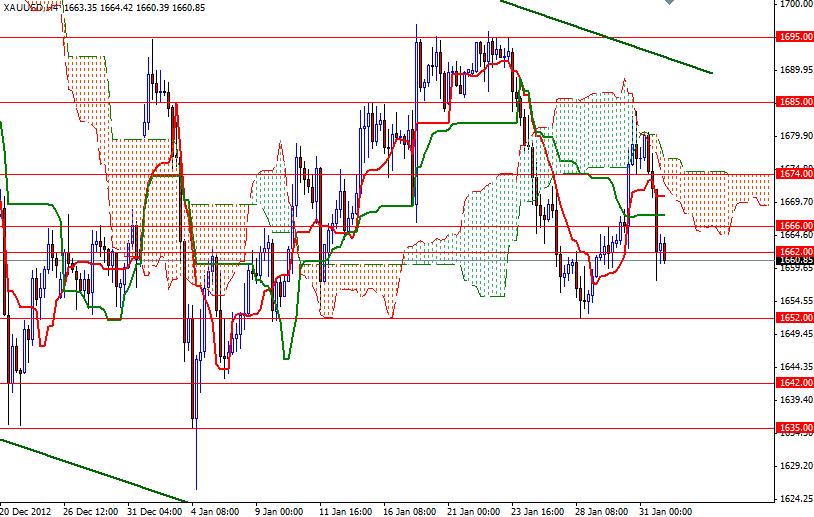

Gold prices declined yesterday as the adrenalin rush of the Federal Open Market Committee meeting wore off. Yesterday, data from the world's largest economy were mixed. The Chicago purchasing managers index came in stronger than expected with a print of 55.6 and Personal Income rose 2.6%. However, weekly unemployment claims rebounded sharply after recent declines in claims and consumer spending figures were slightly below forecasts. Today the market's focus will turn to the U.S. employment data. Pattern on the charts suggests that the XAU/USD pair will continue to remain under selling pressure as long as we trade below the Ichimoku clouds. Also note that the pair continues to trade within a descending channel formation dating back to the October 5 high of 1795.75. On the daily and 4-hour charts, Tenkan-sen line (nine-period moving average, red line) crossed over the Kijun-sen line (twenty six-day moving average, green line) but prices are still below the Ichimoku cloud.

That means the bulls has to break and hold above the 1675 level in order to gain enough strength to challenge the bears at 1685 area but before that 1666 will be the first hurdle. In the meantime, I will be following this descending channel and I don't see any change in the trend unless 1695 is broken. If the American dollar gets a boost from the upcoming fundamentals, we will probably see gold prices falling once again. If the XAU/USD breaks below 1657, look for 1652, 1645 and 1635.