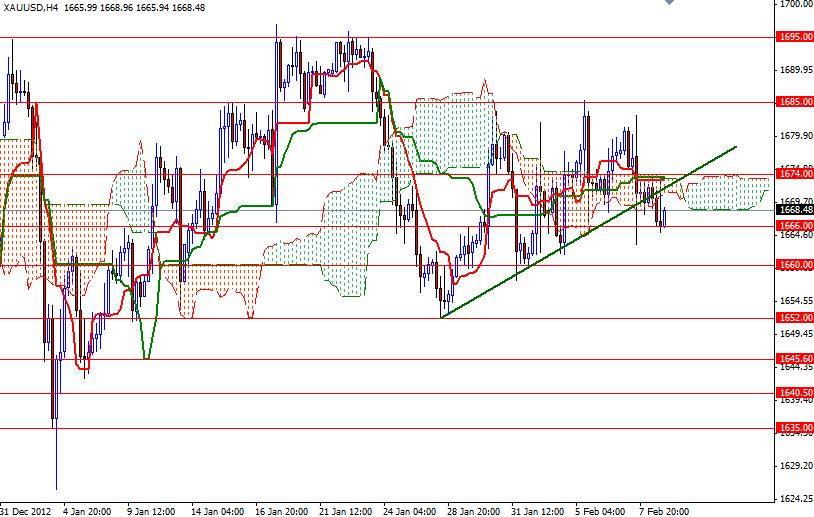

The XAU/USD pair continued to consolidate roughly between 1660 and 1685 throughout the week. Positive signs for the U.S. economy and the recent strength of the American dollar have been denting the precious metal's safe-haven appeal. The pair continues to find the 1685 level far too resistive to conquer and as a result it is likely that we will remain trapped in the descending channel which prices have been running in since the beginning of October. The daily chart is giving us mixed signals from a technical point of view. The pair is trading below the Ichimoku cloud but the Tenkan-sen line (nine-period moving average, red line) is moving above the Kijun-sen line (twenty six-day moving average, green line).

Although the 4-hour chart generated a bearish signal, the bulls have been so persistent about buying on dips and protecting the 1660 floor. Because of that I will not consider this pair truly bearish until break out of the last week's range. If the XAU/USD pair can close lower than 1660 level the greenback will win the first round and it will be possible to test the 1652 support level. A break below 1652 should accelerate its descending. In that is the case, 1645.60 and 1640.50 will be the next possible targets. However, if the bulls manage to break and hold above the 1685 level, then it is entirely possible that we will see the pair challenging 1695. The 1695 level is the most important resistance level as far as I can tell and it is just above the upper band of the descending channel, so a daily close above that level would suggest that the bulls are firmly in control.