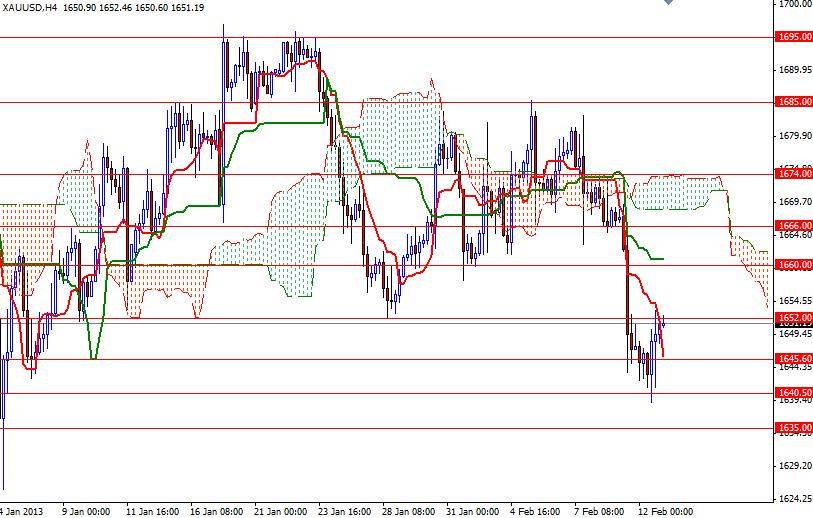

The XAU/USD pair (Gold vs. the American dollar) bounced off of the 1640 support level and formed a hammer yesterday. The pair closed the day higher after three consecutive days of losses as the American dollar lost strength against most of its major counterparts. It appears that investors took some of profit off the table after the G-7 said “We reaffirm that our fiscal and monetary policies have been and will remain oriented towards meeting our respective domestic objectives using domestic instruments, and that we will not target exchange rates” in a joint statement. On the contrary, many nations have been allowing their currencies to depreciate in order to spur economic growth. Yesterday's price action suggests that the market participants will stay sensitive to headlines ahead of the G-20 meeting this weekend. In the meantime, near-term charts are turning slightly bullish, indicating that there is possibility of trading higher before going further south. Prices often return to a (support/resistance) level it has struggled to break out of before continuing the trend so a bounce towards 1660 or even 1666 wouldn't be surprising but of course the bulls will to break through the 1652/6 resistance zone first.

Beyond the 1666 level, I see strong resistance at 1674. Bear in mind that the U.S. retail sales numbers will probably be the key focus for some investors today. If the USD bulls regain their strength and prices turn south, look for 1645.60, 1640.50 and 1635. Until we break out of the descending channel which the pair has been following, I am not comfortable going long in this market.