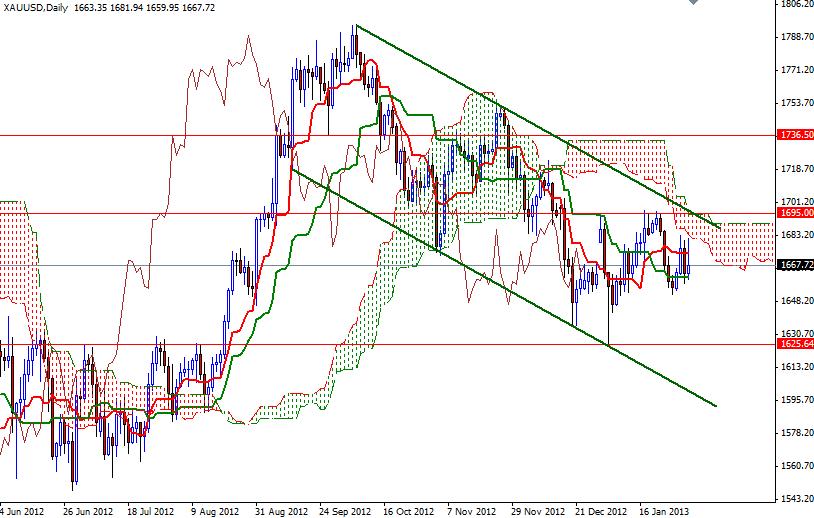

The XAU/USD pair closed higher than opening on Friday as the American dollar lost strength after the unemployment figures came in worse than expected. Initially the pair traded as high as 1682 after the jobs report. Data released by the Labor Department showed that the U.S. economy added 157K jobs in January and the unemployment rate edged up to 7.9%. However prices dropped all the way back to the 1662 level on positive University of Michigan Consumer Sentiment and Institute for Supply Management Manufacturing PMI reports before settling at 1667.72. The latest numbers revealed that the UoM consumer sentiment index rose to 73.8 from 72.9 and ISM Manufacturing PMI climbed to 53.1 from 50.2. It appears that the weak recovery in the labor sector reinforced the expectations the Federal Reserve will not stop its aggressive asset purchases in the near future. By looking at the last price actions, we can see through the daily graph that the XAU/USD pair encounters a strong resistance each time it rallies towards 1685.

We have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses on the charts (except the weekly) but the Ichimoku clouds are blocking the bulls' way. Since we have a mixed technical picture, I will be paying attention to 1674 and 1660 levels. I think a daily close below the 1660 would send this pair back to the 1652 which is the key support level. If we break below this level, we may see a sustained sell-off. If that is the case, expect to see some support at 1645.60 and 1640.50. If the bulls take over and successfully push the pair above 1674, look for 1680, 1685 and 1688.80.