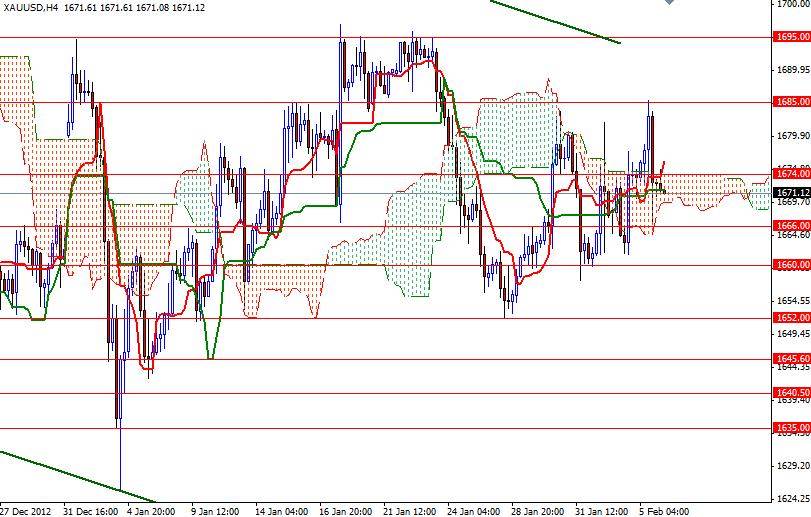

The XAU/USD pair hit a wall at 1685 and closed the day slightly lower than opening. This zone at 1685 is a tough nut to crack and has provided support and resistance since December 2012. As a result, the pair retraced back to the 1666 level before recovering to 1674.50 during the Asian session today. Sharp rises in equities market eased the shiny metal's safe-haven appeal as the risk on attitude came back into the play. The markets will be looking ahead to Thursday’s ECB policy meeting. Market players will also focus on Chinese economic data which will come out on Friday. Although we have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses on the daily and 4-hour charts, the Ichimoku clouds and the top of the descending channel continue to block the bulls' way.

Because of this, until the bulls break through the 1695 resistance, I think the bears will be in charge. We have an intra-day resistance at 1678.50 but if prices climb above this level, there is a chance we will revisit 1685 again. However, a successful close below the 1695 level could change shift things to the bulls completely. If that happens, the next targets will be 1703 and 1711.60. If the pair resumes its bearish tendencies, expect to see support at 1666, 1660 and 1652.