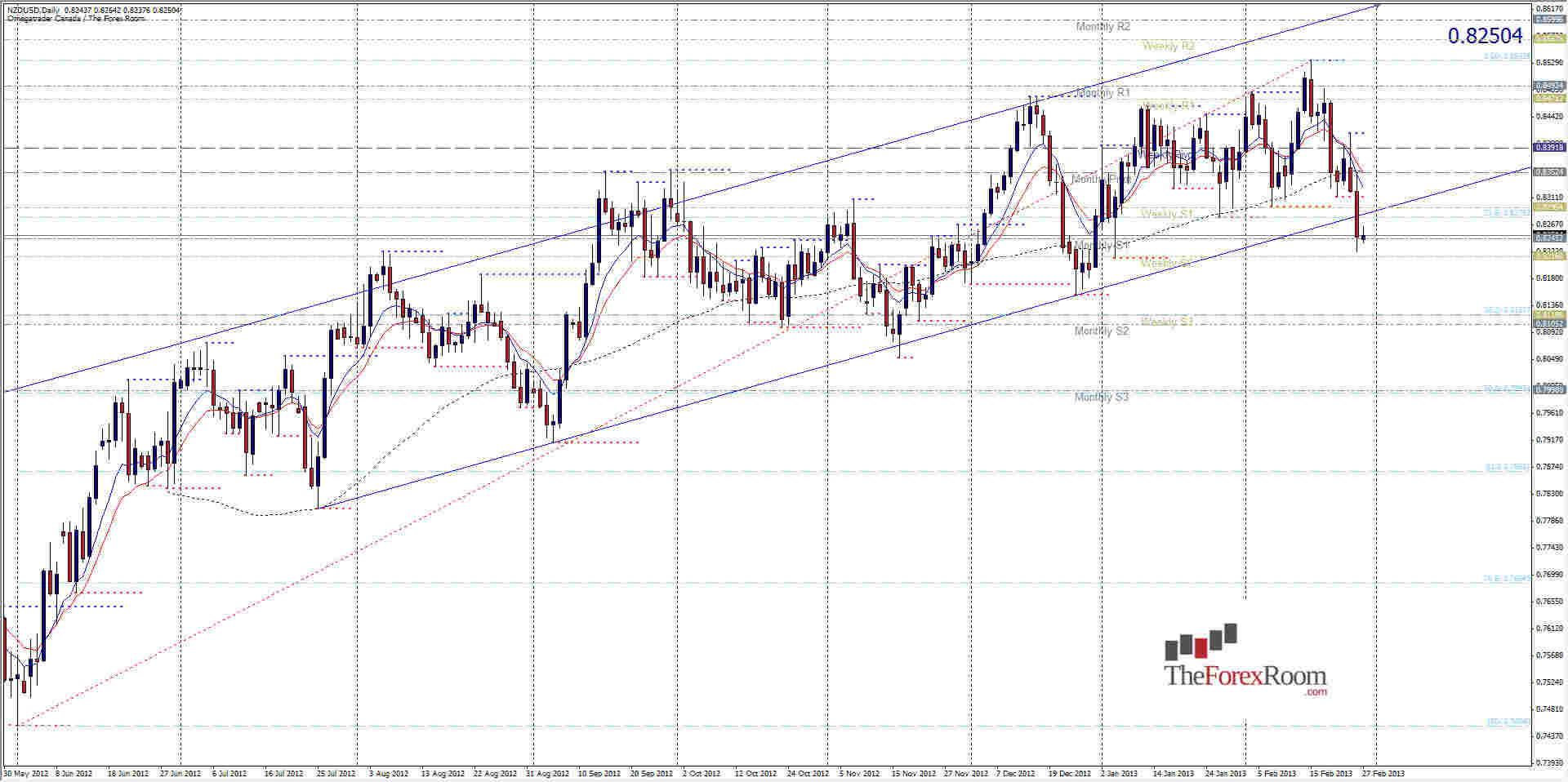

The NZD/USD has closed, and quite strongly I might add, below the lower band of an ascending channel that the pair has been trading in for the past 6 months. Closing yesterday at 0.8247 the pair broke the channel at roughly 0.8280 and appears to be heading for 0.8170, the 50% Fibo level for the entire range spanning from 0.7800 to 0.8533. Support has allot going for it at the 0.8200 area with the pair spending September through December using the level as a pivot and there were numerous closes at this level during this period. If the 0.8170 level is breached the next logical target will of course be the 61.8% retracement level at 0.8080. It is also possible that the pair will re-test the level it has just breached and go back up to 0.8280 at some point before falling further, in which case Resistance of an Intraday nature will be key at 0.8275 & 0.8296 respectively. A close back above 0.8300 will draw resistance again from 0.8325 and 0.8380 with the top of the channel waiting way up there at 0.8600.

Kiwi Bears Break Channel

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- NZD/USD