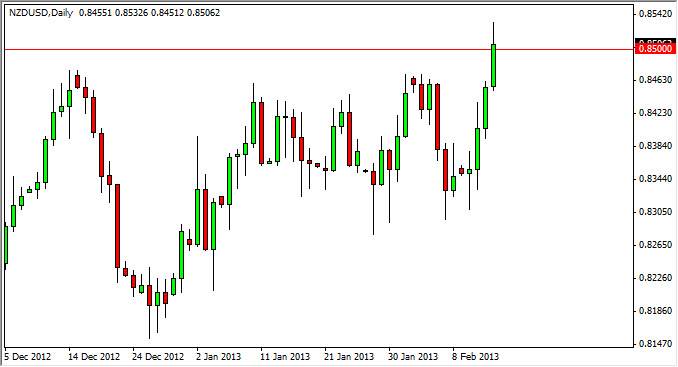

The NZD/USD pair rose during the session on Thursday, as the retail sales number out of New Zealand came out 1.6% better than expected. This of course is very bullish for the domestic economy, and as a result we finally managed to break through the 0.85 handle that has been so resistive lately. However, as I write this during the GMT day change, we are starting a pullback towards the 0.85 level. It is because of this that I think that this market needs a bit more juice to get higher. However, I believe that a break above the highest from the session is one of the clearest indications to start buying a currency that I can think of in the Forex market presently.

The breakout would be significant basically because of the massive consolidation area that we have been stuck in for so long. At the bottom of the consolidation area, we have the 0.75 level. If you take the height of the area, you have a move all the way the 0.85, which of course is 1000 pips. You take 1000 pips and added to the breakout point and then you get the target. In this case, that is 0.95 for the final move.

Don't forget the Federal Reserve

On top of everything else, you have the Federal Reserve and its massive quantitative easing policy. Because of this, the US dollar is losing ground against many other currencies overall, and if we find a lot of growth in New Zealand as indicated by a retail sales number that is better than expected, money will fly into that country again. New Zealand was once the darling of the so-called "carry traders", as the interest rate was so much higher than in other places like Japan. In fact, New Zealand traditionally has had the highest interest rate of the large economies around the world.

Again, if we managed to break the top of the candle for the Thursday session, I believe that this is a buy-and-hold type of opportunity just waiting to happen. As far as selling is concerned, I have no interest in doing so regardless.