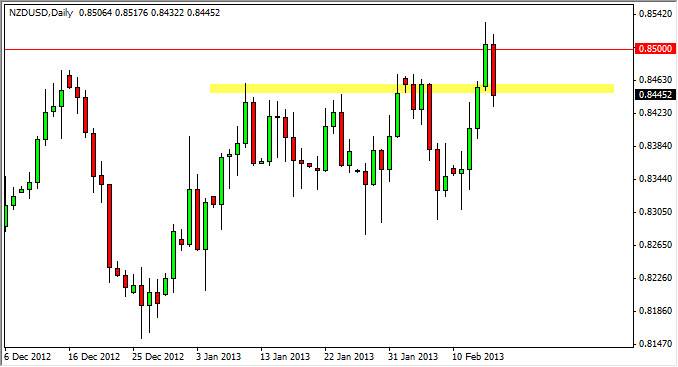

The NZD/USD pair fell rather harshly during the Friday session as the 0.85 level offered far too much resistance. New Zealand retail sales came out and push the pair above the 0.85 handle during the late date Thursday, but as you can see by the time we close the session on Friday we had close below the 0.8450 level. This of course is a very bearish turn of events, but as you can see below that there is quite a bit of noise and strength. Because of this, I believe that a buying opportunity is about to happen.

I still think that the 0.85 level will be broken to the upside and that the larger consolidation rectangle will be validated. This rectangle is worth roughly 1000 pips, and as a result I think this pair will go to the 0.95 handle. Of course, when you have a move that large you have to try and figure out why it would happen, so that you can at least have a reason to believe it. Simply put, this is a tale of two central banks.

Kiwi strength is no problem

In this currency pair, you have two vastly different central banks. On one side, you have the Reserve Bank of New Zealand, or the RBNZ, who has no issue with a stronger Kiwi dollar at the moment. Simply put, they are not willing to participate in the global "currency war" at the moment. On the other side of the equation of course is the Federal Reserve, the absolute kings of currency devaluation. Because of this, this pair could be a one-way trade fairly soon.

The New Zealanders actually mentioned that a higher key we wouldn't cause much in the way of problems for their economy recently, and this of course was like an open invitation for currency speculators to start buying the Kiwi. As you can see on the chart, there has been a grinding higher anyways, and as a result I think that if we get a supportive candle I will more than likely start buying somewhere between current levels and 0.83. I simply believe that it is only a matter of time before this pair breaks out to the upside. This could very possibly be a long-term move as well.