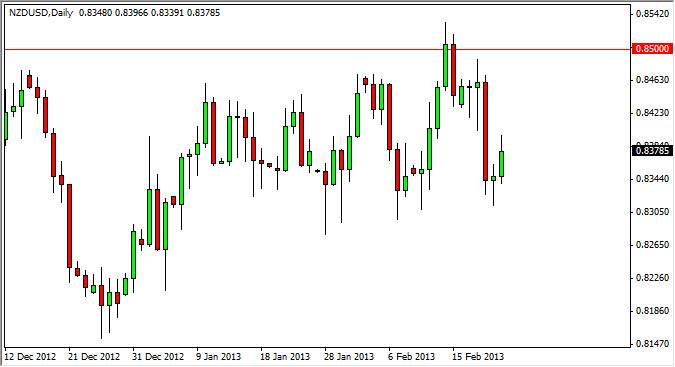

The NZD/USD pair rose during the Friday session after printing a nice looking hammer on Thursday. I had mentioned that the 0.8350 level look like it was trying to offer support, and I do believe that the 0.83 level is the ultimate part of that support zone. Because of this, a break of the top of the hammer made perfect sense and it certainly was a nice buying signal. I went long during the Friday session, and remains over the weekend.

Looking forward, I fully expect this pair to continue to consolidate between the 0.83 and 0.85 level unless proven wrong. I believe that the slight upward tilt of the momentum in this pair suggests that we are going to breakout to the upside, and when we do we could see a move is much is 1000 pips. In a sense, it's like a market back enough to get enough momentum to break through the barrier.

Knee-jerk reaction to an errant comment

Due to an errant comment by the chairman of the Reserve Bank of New Zealand, the market fell apart on Wednesday. Essentially, it was stated that the Kiwi dollar was in a "one way back", and that the RBNZ would be willing to intervene if the value of the Kiwi got too high. However, this is a battle between two central banks trying to devalue their currencies. In a sense, New Zealand is a necessarily trying to devalue the Kiwi; it is simply trying to slow down the ascension. On the other side know, we have the Federal Reserve, the masters of devaluing currency. Because of this, the Kiwis are certainly outgunned and fighting a battle that they simply cannot when.

So by "losing", New Zealand will find its currency going higher over the long run. I firmly believe this is the way it's going to happen, and that it has more to do with central bank meddling than anything else. With this being the case, I am bullish of the Kiwi dollar, and will buy every time it pullback to this general vicinity.