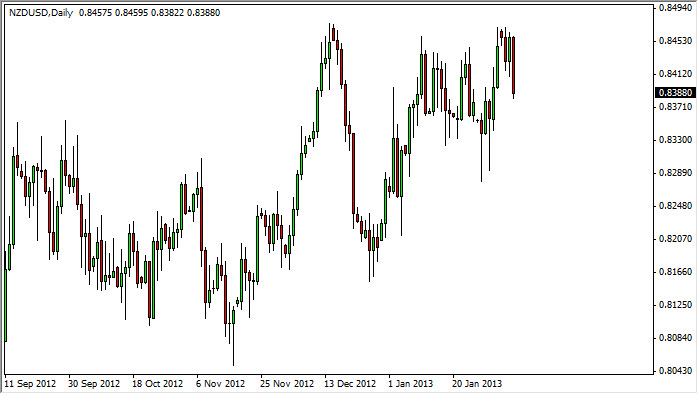

The NZD/USD pair fell rather dramatically during the session on Wednesday, but it was late in the day and after the employment numbers came out of New Zealand. Initially, we only had a slight selloff, but with the -1% employment numbers coming out of Wellington, this of course had people getting out of the Kiwi dollar. Because of this, the charts are a bit misleading as it was a knee-jerk reaction.

Look in the chart, I cannot help but notice that there is a lot of noise between here and 0.83 as I can see a nice looking hammer at the lows. This chart is going to be one of the more interesting ones for me going forward, because I feel that this is a battle between the fast printing Federal Reserve, and the potential growth that Asia could be going through. After all, it is often forgotten but nonetheless true that the Kiwis export quite a bit to Asia as well. Typically, people think of the Australians when they think of Asia, and the Kiwis are somewhat of a little brother when it comes to this. However, this is a mistake as the less liquid New Zealand dollar market offers larger gains most of the time.

Consolidation

The look of this candle is rather ugly. It is because of this that I am not jumping into this market to buy right now. However, it's plain to see that we are in a massive consolidation area. I believe that there is a lot of noise below, and I also believe that traders know that the Federal Reserve is going to continue to print going forward, and that the US dollar will weaken overall.

In order to get a signal for this pair, we will probably have to wait a day or two but recognize that the 0.8350 level begins significant support going forward, and as a result I will be looking for some type of supportive candle in the general vicinity. A hammer would be lovely, as would some type of bullish engulfing candle. I have absolutely no plans to sell this pair right now.