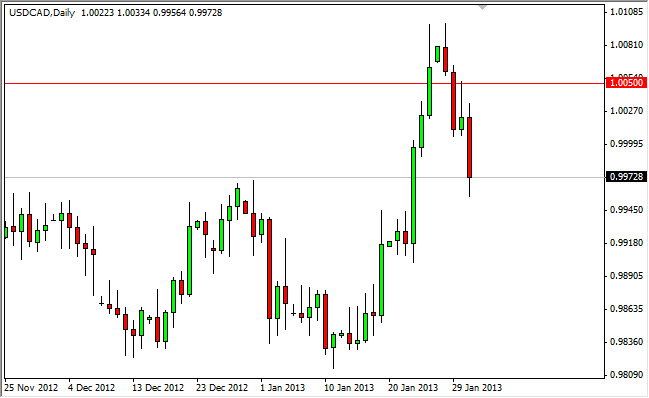

USD/CAD had a very negative session on Thursday as you can see on the daily chart, break in the bottom of the Wednesday shooting star that sent just on top of the parity support level. Because of this, it looks like this market is starting to break back down and is starting to test serious support at the 0.9950 level. At the end of the day, we did see a bit of a bounce from the level, but it must be said that this large red are still looks very weak.

With nonfarm payroll being today, this pair will get thrown around quite a bit. This pair is one of the most sensitive to the nonfarm numbers, and as a result is normally one of the better trade. The fact that we are falling at this point time suggest bullishness in equity markets, and possibly the jobs numbers. This pair tends to fall when economic numbers are good in the United States. While it may seem a little bit counterintuitive, the Dollar loses against the Loonie when times are good. This is simply because the Canadians export so much the United States that money floods into Canada to buy oil, lumber, and many other minerals.

0.9950

The 0.9950 level looks like a fairly significant support level from we can see. However, the candle looks very weak from the Thursday session, and it does suggest that we could see a bit of follow through. However, there is the alternate argument that we are simply retesting previous resistance area. I find that interesting, so while this is a bit of a "50-50 ball", I think the daily close from the Friday session will be vital as to which direction we go in the future.

Watch the oil markets as well if you want to find out what the move is all about. If this market falls, the jobs number out of America is strong, and the oil markets are all rising, they need to be a bit more confident in the move lower as it would be a sign of a very bullish market for risk appetite. However, if you get a lot of conflicting signals, you're going to be better off simply waiting to see what happens at the end of the day in order to make your next trade.