The USD/CAD pair gained again during the Monday session as the “risk off” trade gained steam again. The oil markets sold off, which almost always leads to a higher print in this market. However, it was the Italian elections that really set the markets off for the day.

The Italians didn’t go with a pro-austerity government as most of the trading community expected, and the “hung Parliament” could lead to another vote. In other words, Italy is stuck in a political quagmire. This really shouldn’t be much of a surprise, after all – the Italians have had a slow economy for a few years now, and to think they would purposely vote for more is a bit odd if you think about it.

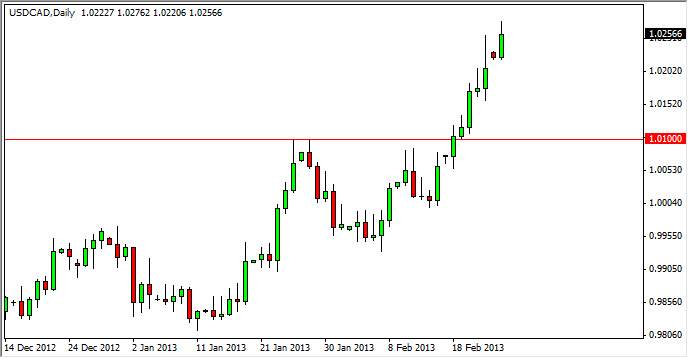

With that in mind, anything of value was dumped and Dollars were raised. The oil markets were hit, and the Dollar in general gained. This of course ran over to the USD/CAD pair as well. This was simply an excuse to push the pair higher again, as we had already broken out and above serious resistance at the 1.01 level.

Pullbacks are buying opportunities. For now.

The pair should be one that continues higher, and I have written in the past that I think it will reach for the 1.04 handle in this move. However, there will always be pullbacks, and I think that signs of support on the lower timeframes will attract buyers as we go along. I see this being the case unless we break below the 1.01 level again, which of course would be a very bearish sign.

The market will more than likely be influenced by things in Europe more than anything else going forward, but via the oil markets. I know it is a bit convoluted, but this is how the pair will typically react to world events – in a very convoluted way. The economies are very interconnected, so watch out for Ben Bernanke’s testimony in front of Congress today as well. There are a lot of moving parts at the moment, so tight stops are recommended.