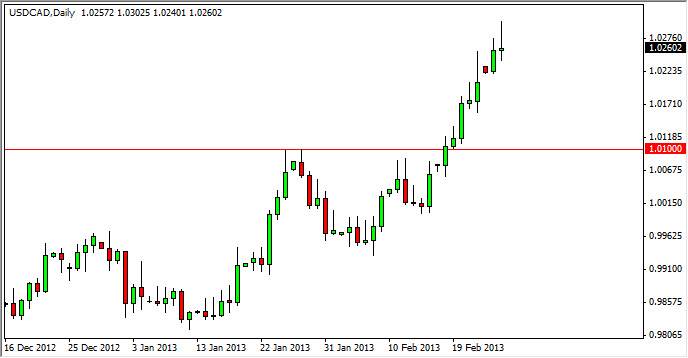

The USD/CAD pair tried to rally during the Tuesday session, but as you can see by the charts we had serious trouble getting above the 1.03 handle. The pushback by the sellers caused the market to form a shooting star, which of course is one of the most bearish candlesticks that you can see.

This makes sense to me though, as we had a significant breakout the 1.01 handle recently, with very little in the way of pullback. In fact, this is basic technical analysis as we would be breaking out of resistance, only to pull back and test it for support. With that in mind, I fully look forward to this pullback as a buying opportunity if we do in fact show support.

Looking at this chart, it does make sense as the oil markets have crumbled a bit, and there is a definite "safe haven" trade out there right now. Going forward, a pullback and eight push up to the 1.04 level is what I expect to play out. However, we have to see some type of support come into the marketplace near the 1.01 level, or above it. If we managed to break below the 1.01 handle, I think this would be a very bearish turn of events, and have a searching for the 0.99 handle in relatively short order.

Bank of Canada

Recently, the Bank of Canada has suggested that any monetary tightening would have to wait a little bit longer than originally anticipated. This caused the market the selloff the Canadian dollar, as the Bank of Canada was considered to be one of the few central banks out there willing to tighten anytime soon. This of course is highly related to what's going on in the US economy, as the Canadian send 85% of their exports down to the Americans. In other words, as long as the American economy is sluggish, so is the Canadian economy. With this in mind, I do not expect any type of massive melt up, but a higher trading range certainly makes sense to me at this time.