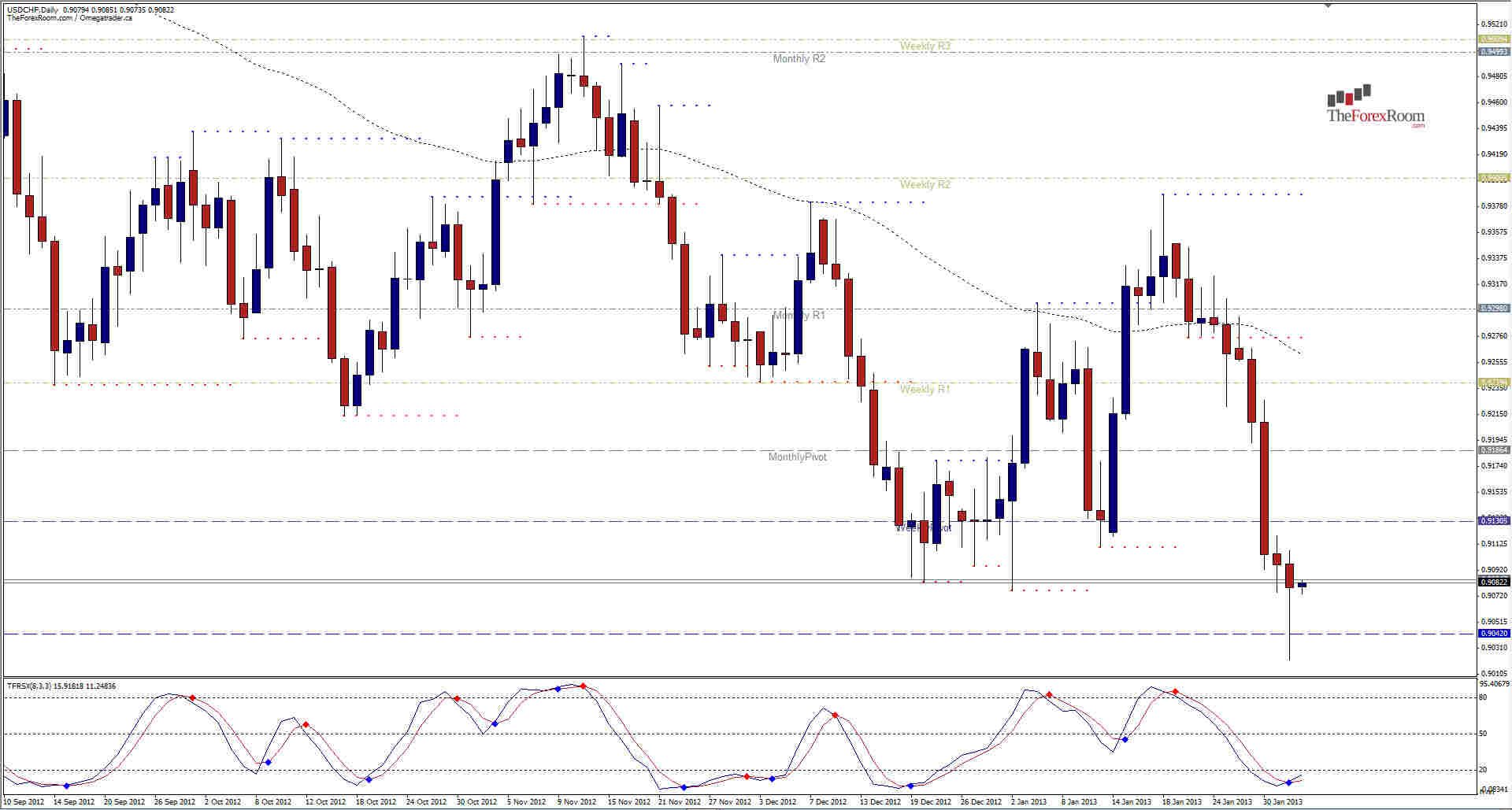

The Swissy aka USD/CHF has rejected the 9000 area, at least for now. The pair reached a low on Friday of 0.90215, and printed a daily pin bar in the process. The candle formed on a level that has stopped the Swissy in its tracks numerous times, at roughly 0.9075. For the past five weeks the pair has been making attempts to close below 0.9000, a level last seen in February 2012 only then very briefly. The weekly candle at the same time has closed as a very bearish engulfing candle while the Monthly candle from January is a form of the 'Hanging Man' formation and suggests a bullish reversal as well. So we have a daily and a monthly candle suggesting a bullish reversal on a strong support zone, with a weekly candle suggesting a continuing bearish trend. Short term, I believe the USD/CHF will turn Bullish but will take at least one more stab at the 0.9000 area. Support above 0.9000 will be the 0.9075 area with further support below 0.9000 at 0.8930, the February 2012 lows. Resistance will come in at 0.9130 and 0.9186 (Weekly & Monthly Pivot Levels) along with the 62 EMA at 0.9262 while the Weekly R1 (and December 2012's low) sits at 0.9239. Taking into consideration Friday's daily candle, the support level and the oversold stochastic reading I expect this pair will bounce today...but will it be a true reversal or a correction is uncertain as of yet with so many mixed technical's.

USD/CHF Rejects 0.9000 - Feb. 4, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.