The USD/JPY pair had a wild ride on Monday, as the Italian elections rocked the markets globally. Because of the unexpected results, many in the markets were caught on the wrong foot, and the US dollar was bought up and over fist. This of course worked in the exactly opposite manner in this market, as it normally does.

The “safety trade” came into play as the Italians voted for many anti-austerity politicians in the parliamentary elections. Many of these people have proposed a rollback of the previous taxes and austerity measures, so this threw the debt crisis in Europe right to the forefront again. This is turn had most traders out there covering their positions as far as risk is concerned.

However, this pair has another major dynamic: the Bank of Japan. The BoJ is still looking to bring down the value of the Yen, and this should win out in the end. However, there was a significant knee-jerk reaction in this pair on Wednesday. This could lead to more selling, but the nice thing about this market is that we have a definite support area below that the entire market should be aware of.

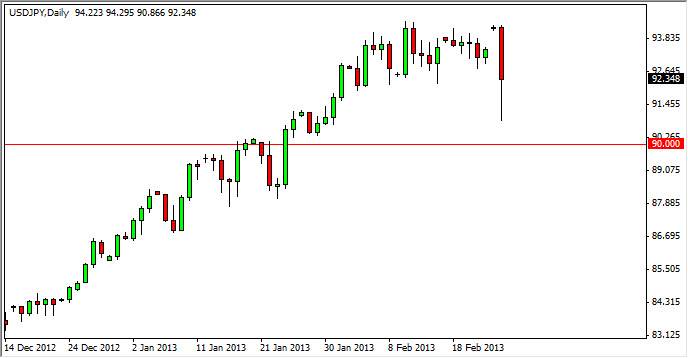

90 is important

For myself, as long as we are above the 90 level, I think this pair will still be significantly supported. This is an obvious cluster in the market, and as a result I assume that our friends in the larger hedge fund community will be paying attention to this level as well. This is one of those times where it is an obvious spot, and that’s what I like about it.

The market is still very bullish overall, and I have thought for some time that I would like to see a pullback. This could have been it, but we will have to see. I think a move down to 90 would be even better, but I will be willing to buy supportive candles in general when it comes to this pair – no matter if it is at 90, 91, or other levels. I believe this pair goes as higher as 100 by the end of the year, and so far I haven’t seen anything to change my mind.