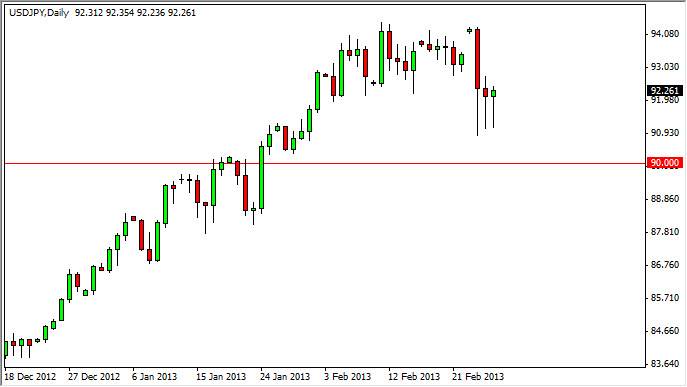

The USD/JPY pair fell again during the Wednesday trading hours, dipping below the 92 handle for the third session in a row. However, for the third session in a row we also saw the market popped back over the 92 handle and form supportive price action. When you look at the chart, you should realize that the Monday candle could be thought of as two separate trading days in some ways. In the later hours, we saw quite a bit of a bounce back in this pair, which would have formed a nice looking hammer if you would've just look at the afternoon by itself. In other words, I look at this pair is having three hammers in a row, something that is extraordinarily rare.

Looking forward, I fully expect this pair to continue higher as the 92 level has offered such great support. Below there, I see the 90 handle as being even more supportive, and therefore even more vital to the bullishness of this marketplace. Over the next couple of sessions, we will see the Bank of Japan Gov. being announced out of Tokyo, and this could cause another knee-jerk selling of the Yen. This of course would move this pair higher, and I believe that the market is destined to continue the consolidation of up to the 94.80 level.

Long-term bull run

I believe that eventually we will hit the 100 level in this pair, and by the end of the year. This was given a boost by something that wasn't very heavily reported: Federal Reserve Chairman Ben Bernanke stated during congressional testimony two days ago that he "fully supported Bank of Japan policy in its efforts to reflate the economy." In other words, it seems like he has no interest in interfering, meaning that he was okay with this particular market going higher. If that's the case, you now have only one central bank pushing this particular pair. In other words, the Japanese are going to "win" the "race to the bottom." With that being the case, I still believe in the long-term buy-and-hold mentality of this pair, but I do recognize the fact that 95 will be a significant barrier to break out of.