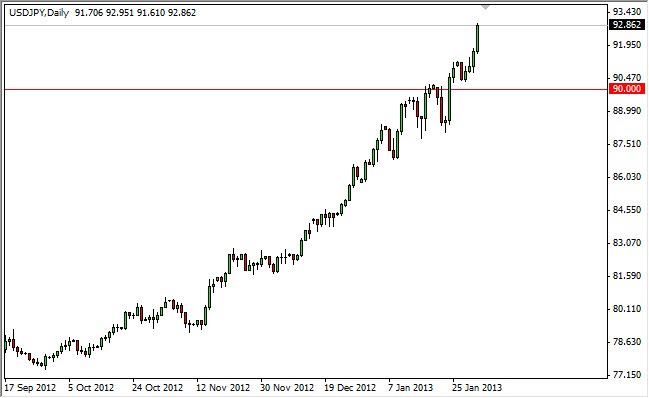

The USD/JPY pair continued to rally on Friday as the Non-Farm Payroll numbers came out as expected. The pair has been brutally bullish lately, and I see no reason to think this is going to change. If you have been reading my articles, you know I consider this a “buy only” pair now, and buying the dips is exactly how I am going to approach this market.

The USD/JPY pair has the advantage of being just above a support area. Contrasting this with the EUR/JPY pair that everyone is long of at the moment, and you can see that in the end this is probably the safer trade. I see the 90 level as being a massive support level, and as long as we are above that general region, we should see continued bullishness.

Even if we managed to breakdown and go below the 90 handle, I think at this point the Bank of Japan and the Japanese government have made it plain to see that they aren’t going to tolerate the Yen being this strong anymore. Quite frankly, I am surprised didn’t do this some time ago. I suspect they simply had to wait until the risk appetite in the markets overall had more strength to it, and now that we do see those “animal spirits back into play, we could see a real run higher.

100

I still think we will see a 100 print by the end of 2013. I know at the moment that seems a long way from here, but looking at what this pair has done since November, it looks as if there is certainly enough fuel in the marketplace to grind that high.

The Federal Reserve will be the one thing standing in the way though. They are presently operating with a very easy monetary policy, and as a result the Dollar in general continues to suffer. However, against the Yen it is a different story. Nonetheless, this makes the ascending of the USD against the JPY much slower than a high flying currency like the EUR. However, this also means any pullbacks will be subtle instead of brutal.