EUR/USD

The EUR/USD pair tried to rally this past week, but found the 1.35 level as being far too difficult to overcome. There seems to be a sudden reversal of momentum in this pair, but the fact is that there are a lot of supportive areas just below current price. Because of this, I don’t feel as confident about shorting it as I normally would, given the fact that the weekly candle is a shooting star at the bottom of a recent pullback – a negative sign. In all honesty, I think a pullback is coming, but it will be short lived as we bounce yet again.

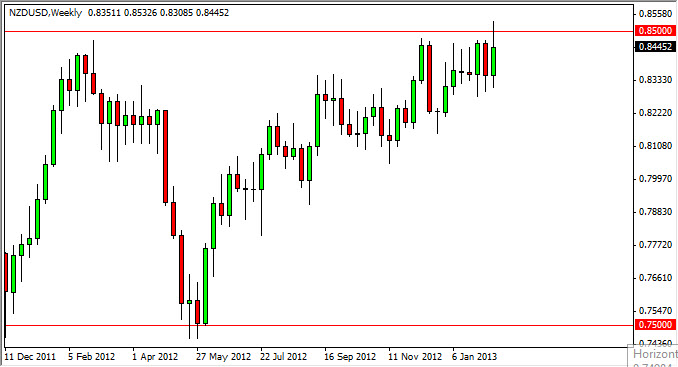

NZD/USD

The NZD/USD pair tried to rally during the week as well, and even made it above the 0.85 level late Thursday. This move was predicated upon the much better than expected retail sales out of New Zealand, but was quickly pushed back in order to close the week under the resistance level yet again.

However, I think this is the pair to watch for the time being. The pressure to the upside has been relentless, and as a result I think we will see this level broken above. Of particular note is the fact that the consolidation area measures 1,000 pips “tall”. This would have the upside target for this pair at 0.95 if we get the true breakout.

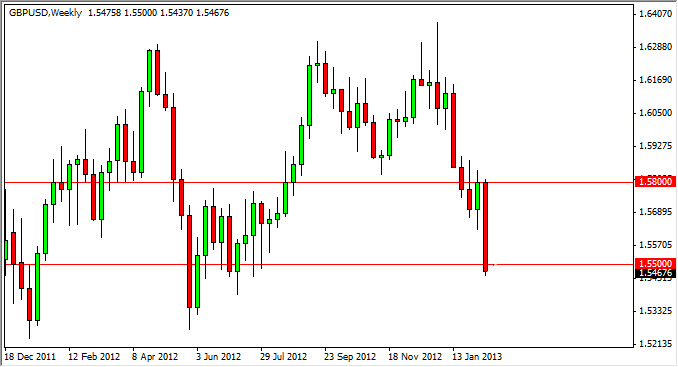

GBP/USD

The GBP/USD pair had a positive week as the pair found a bit of support at the 1.55 level. This makes sense, as the market has been pretty much in a free fall for some time now. However, I think this is simply a bounce in the market as we finally need it to attract more sellers. Pay particular attention to price action and behavior around the 1.57 area. I believe that sellers will step in a push this pair down from that level if we get a bounce. As for buying – it isn’t a thought until we are over the 1.59 level.

GBP/CHF

The GBP/CHF pair has been selling off as well. The pair should be in focus in the coming week as the 1.42 level should be important support. As the chart attached to this article shows, we could see an acceleration in the decline of this pair if that level gives way. On a daily close below it, I am inclined to start selling this pair.