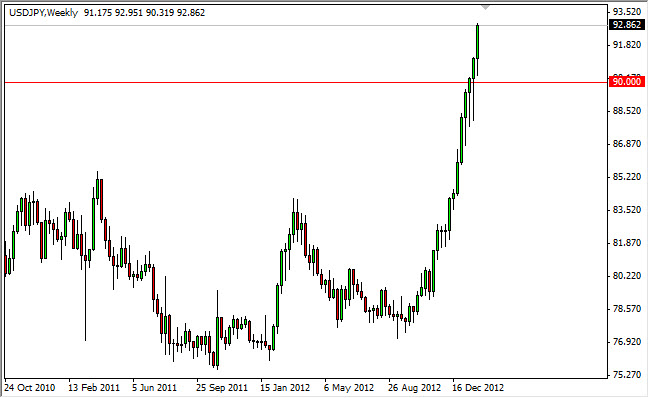

NZD/USD

The Kiwi originally fell for the week, but by the close of business on Friday, we saw this pair test the 0.8450 level yet again. At this point, I have to ask how much longer this can really go on. The area seems to be very resistive, but in the end should give way. However, I believe the area actually extends to the 0.85 level, and because of this I am not going long until that area is captured by the bulls. I will use a daily close above that level to signal a buy order.

The recent consolidation extends down to the 0.75 level, and as a result I think we will eventually find the 0.95 level as a target. Needless to say, this won’t happen overnight, but there is a good shot this means that the pair will enter another bullish run at this point.

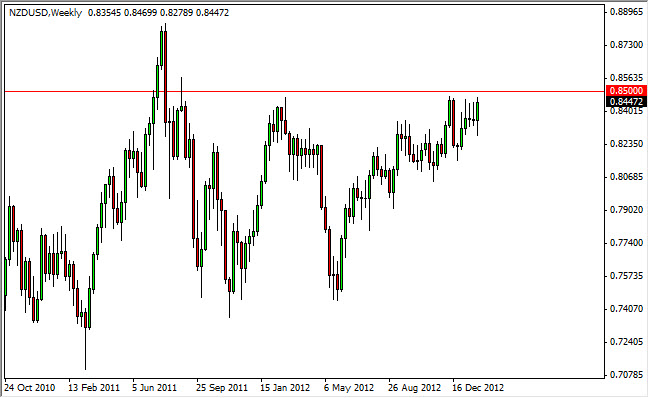

EUR/USD

You guys all know I have been watching this pair for a potential massive signal. We got it this week, as the neckline of a massive inverted head and shoulders was broken. Looking at this chart, the typical technical analysis suggests that we should see a move from the neckline that equals the height of the head and shoulders pattern. Because of this – I think we reach just under the 1.50 level. In fact, I am calling the final target at 1.4950 for the pair.

Obviously, we won’t go straight up, but there is now a clear bias in this pair. This means you can have a core position, and add and subtract as time goes on. I personally am long of this pair, and plan on building on pullbacks at this point.

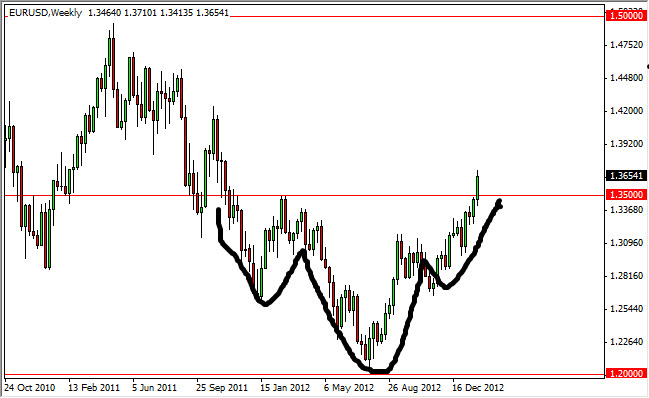

GBP/USD

Cable attempted to rally over and above the 1.58 level, but failed this week. It is at this point that I have given up all hope that this pair is going to bounce hard, and it now looks completely broken. However, there is still a lot of noise below the current level, and as a result I think the move could be very choppy going forward. With this in mind, although I see a lot of weakness in this pair’s future, I won’t be bothered with it. If I want to short the Pound, I will do it against the Euro.

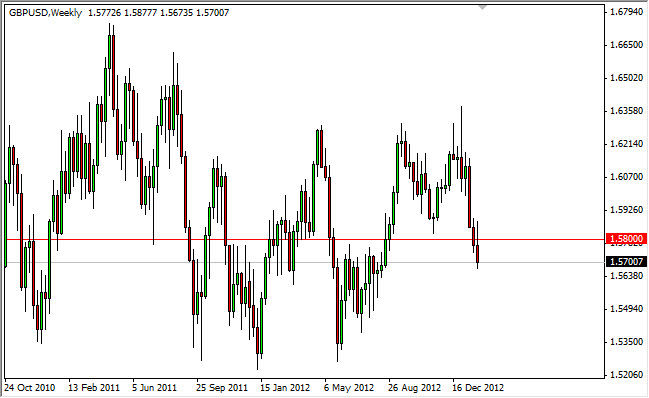

USD/JPY

The only chart more ridiculous than this one is the EUR/JPY. However, this one does have the advantage of having a major support level in the neighborhood, and as a result I find it a bit more interesting than the EUR/JPY pair. The 90 handle should be a bit of a “floor” in this pair going forward, so I think that any pullback to that area should be a reasonable area to start to look for supportive candles to buy. Obviously, selling this pair isn’t an option.