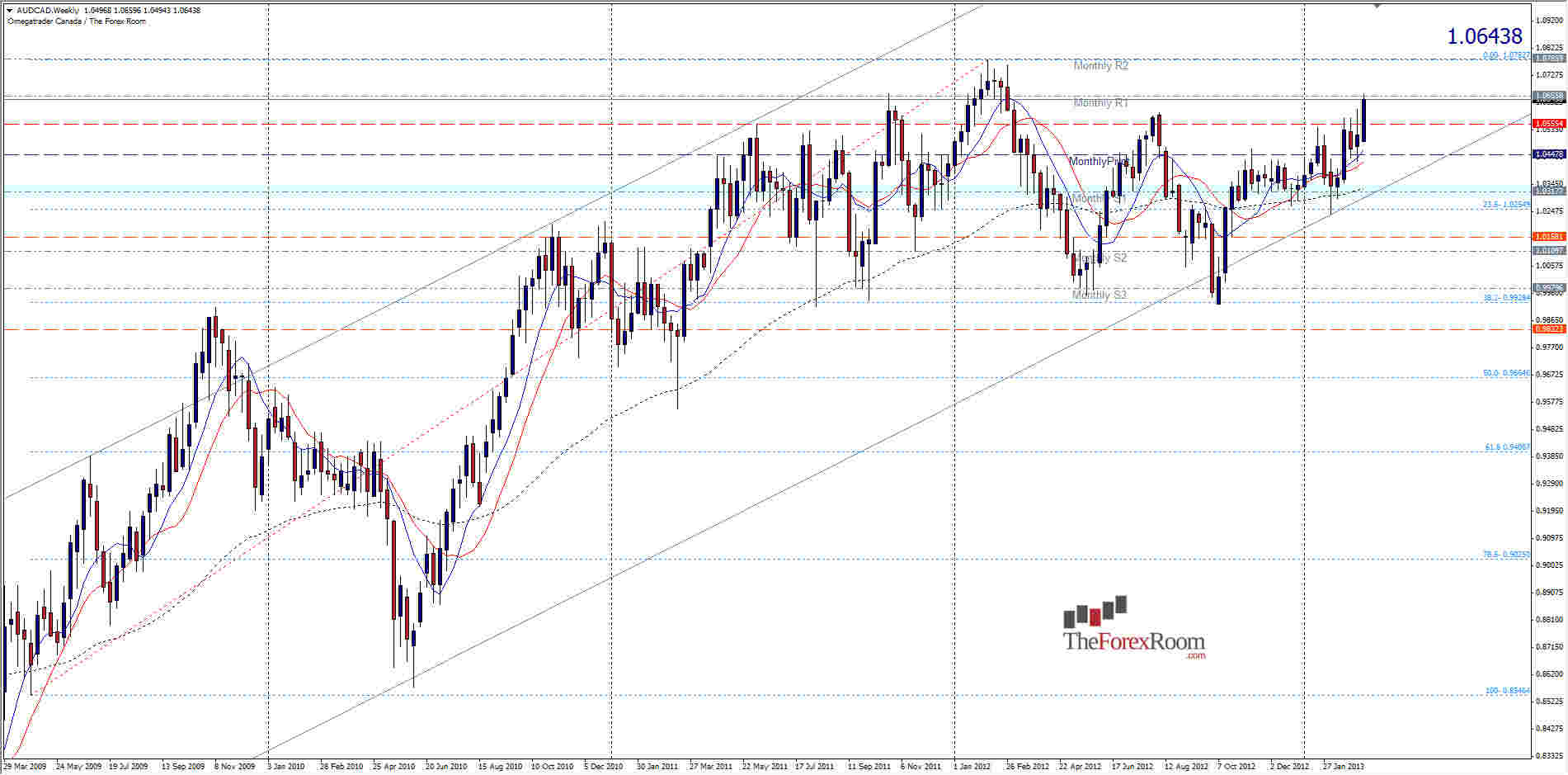

The AUD/CAD, like its cousin the AUD/USD shot upwards after the unemployment rate improved drastically last month. The numbers were in fact astounding, but now the pair faces a strong resistance level seen easiest on the Weekly chart below. Previous highs and lows from weeks & years past, and a Monthly R1 as a result, sit directly in front of the bulls path higher. 1.0650 is a key level for this pair as 1.0400 is for the AUD/USD. We have to go all the way back to 1996 in fact to see the real resistance that awaits this pair at this level. For now, if we do head higher the next likely target will be the almost 15 year high established in February 2012 at 1.0785. Resistance will come in the form of several weekly closes at roughly 1.0680 once above 1.0665, but other than that, there isn't much. If we reverse, and this is possible especially if we get one more failed push to close above 1.0665 we will encounter resistance at the August highs around 1.0600-1.0550 and then some serious support comes into play at 1.0450 as the 38.2 FIBO and Monthly Pivot combine.

AUD/CAD Continues Higher Mar. 14, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- AUD/CAD