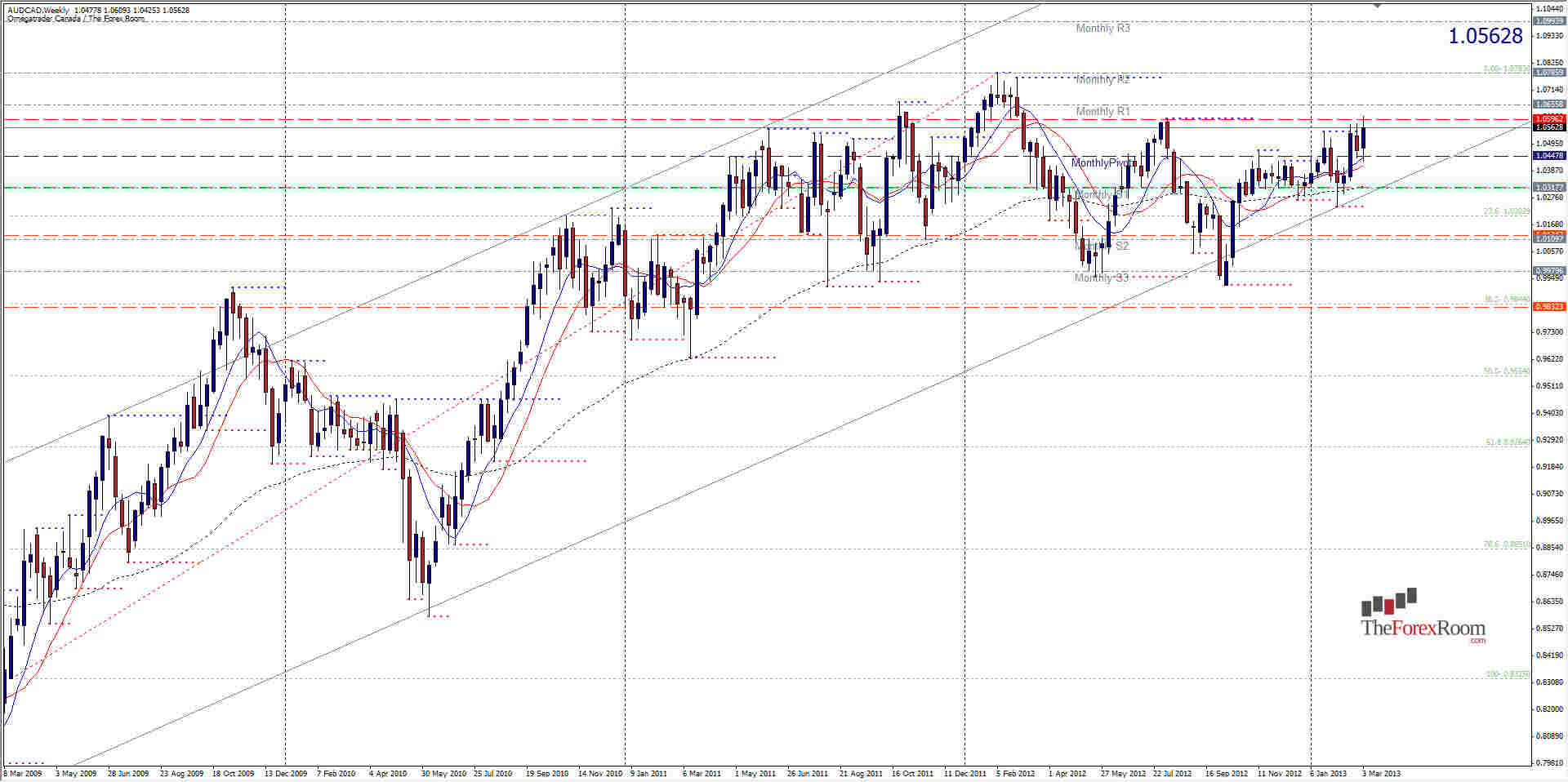

The AUD/CAD pair breached the 8 month high at 1.0596 yesterday trading as high as 1.0609 before pulling back to close higher than opened at 1.0559 and printing a pseudo pin bar on the Daily chart. Prices for this pair have not hit 1.0609 since the first week of March in 2012 and it appears we have a classic case of history repeating itself after the Canadian PMI fell 7.6 points and saw the Loonie jump 45 pips in a flash. Combined with a resilient Aussie Dollar this is driving the pair ever higher. Prices have reversed from this very level several times and only once or twice traded much higher. If we continue northbound, the next likely target is the February 2012 high at 1.0783 and then the 1995 through 1997 highs at 1.0950, 1.0984 & 1.103 ultimately. However, as price struggles to break this level and has reversed here more than it has broken through, the more likely scenario is that we will see this pair begin to fall soon and test January's high at 1.0546 on the way down to 1.0495, the Weekly Pivot. Below this we have the November highs at 1.0469 and a Weekly S1 at 1.0412 coinciding with the top of the November-January consolidation zone.

AUD/CAD Hits 12 Month High

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- AUD/CAD