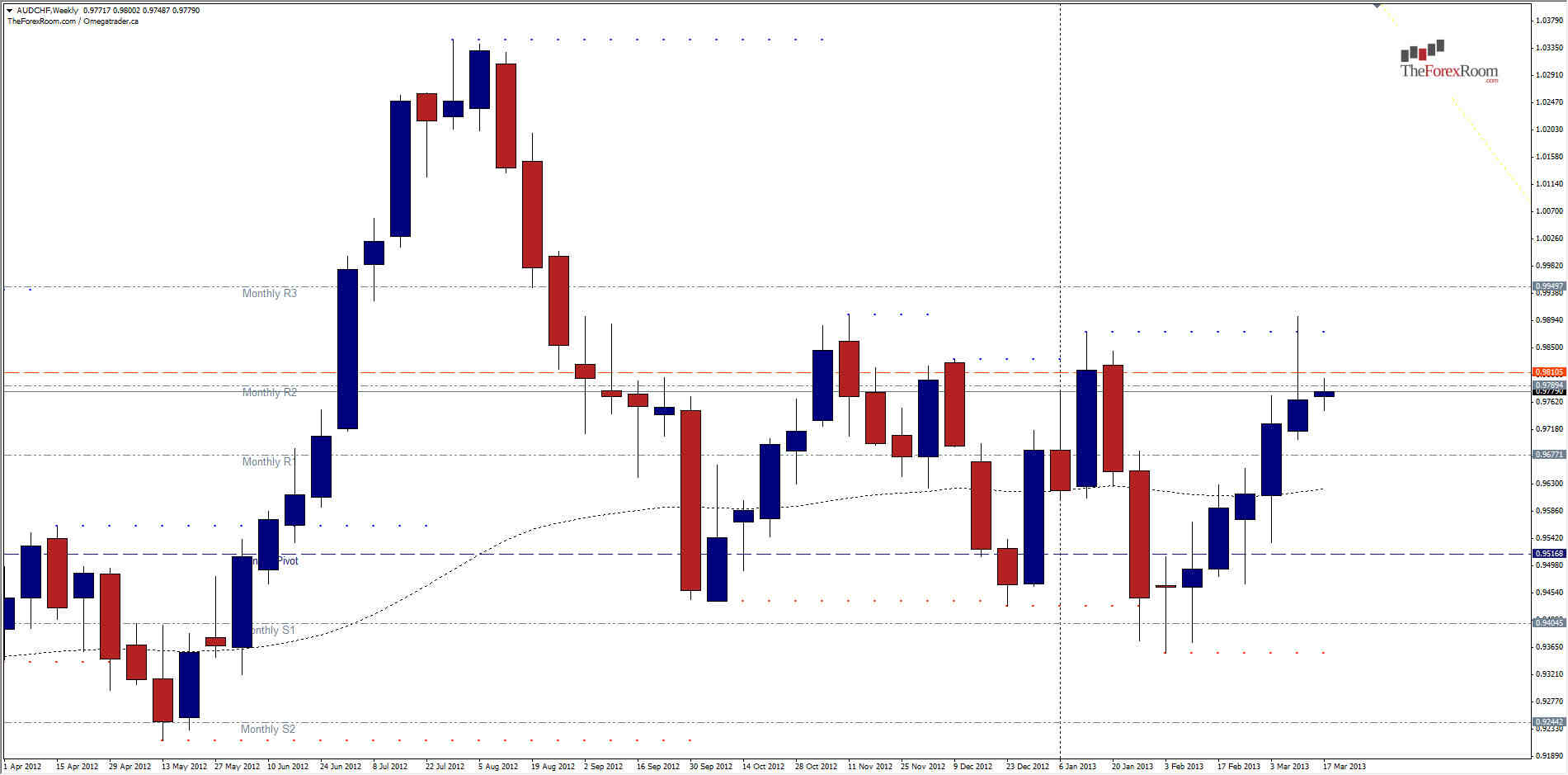

The AUD/CHF has printed a Weekly Pin Bar Reversal. The Pin Bar Reversal, for those that don't know already is an excellent trading tool when it forms at a key Support or Resistance Level as is the case with this weeks's AUD/CHF. The pair pushed as high as 0.99006 last week but was unable to hold the 0.9900 level and closed the week much lower at 0.97056. The 0.9900 level is indeed a key level for the pair, with numerous failed attempts to break higher. We now also have a bearish Head & Shoulders pattern on the Weekly Chart with the right shoulder being made up of a 4 touch top, the last of which ending in the current Pin Bar. Price may attempt to push higher once again but will encounter the usual resistance and when/if this resistance holds, a break of last week's low should signal a new bearish run. The first level of support will be the 0.9560 area where we see numerous highs including those of the left shoulder in the Head & shoulder pattern. 0.9430 area will be the next hurdle for the bears with both previous highs and lows at this level including the lows from February of this year, and finally the 0.9200 area/lows from May 2012 will act as support below which is an almost 2000 pip technical vacuum with very little support to keep prices from reaching the 2011 lows once again at 0.7138.

AUD/CHF Weekly Pin Bar- Mar. 18, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- AUD/CHF