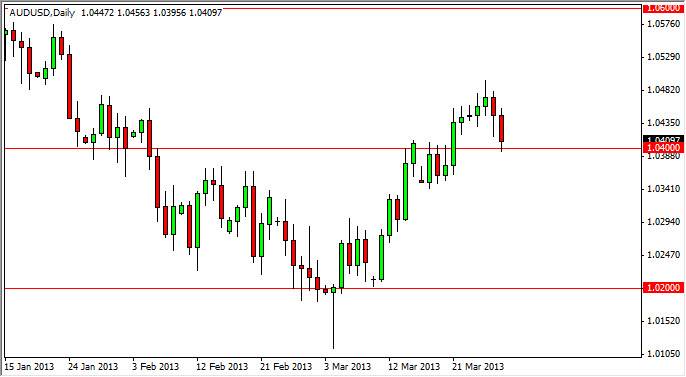

The AUD/USD pair fell during the session on Thursday, testing the 1.04 level as support. So far, it has held but it should be said that we are closing just above it. The area just below the 1.04 level does look rather congested though, and as a result I believe that we will see supportive action.

Is that supportive action that leads me to believe that buying the Australian dollar can be done at this point. Depending on the candle that we see, I may or may not be aggressive about it. Another thing that could help is whether or not we see gold rally. The Australian dollar, as many of you know will follow gold over the long-term. If that goes on, in theory the Aussie should too.

As for selling is concerned, it's going to be difficult for me to do so as I see so much in the way of noise and support below. I can see that the 1.03 level offer support, and I can also see that there is a cluster going all the way down to 1.0350 from the current price action. With all that being the case, it's really difficult to sell as I don't see as clear a path to the downside. Also, one has to keep in mind that the Federal Reserve is going to continue to ease and buying back assets on the open market. This of course over time should weaken the value of the Dollar, it's especially gives higher-yielding currencies. (Granted, there is the whole thing about the Euro right now, but in general this tends to be true.)

1.04 is important, pay attention.

This area that we are testing right now is important for the future of this pair. It is essentially the "middle point" of the larger consolidation area that starts of the 1.02 level. That area is extremely supportive, just as the top of the rectangle is extremely resistive, found at the 1.06 level. The pair should try to reach that area over the next few weeks. However, if we go through it – we could be looking at a move to the 1.10 level.