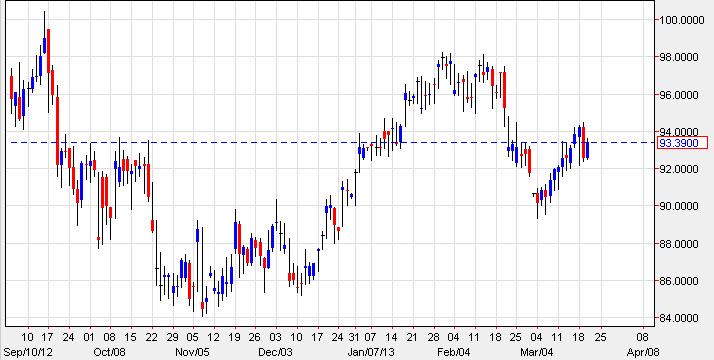

The WTI market had a decent showing on Wednesday as the $93.00 level continued to offer a bit of support. However, I truly believe that this market is more or less going to be range bound through most of the summer, and I am assuming that the range is being formed as we speak. This market quite often will get stuck in a range, and is very technical and its nature. Because of this, we tend to see these ranges form for several months at a time.

Looking at this chart, I think is becoming more and more clear that the $96.00 level will be some type of resistive area. I don't know whether or not it will be the actual resistance, or simply the beginning of resistance all the way up to the $98.00 handle. Either way, I do see that the $90.00 level looks very supportive at this point, and it should continue to offer reactionary forces to price every time we approach it.

The Federal Reserve reinforced that it is going to keep a fairly accommodative policy going forward, and this of course would give credence to commodities rising and the US dollar falling. However, these are not common times we live in, as the US dollar is gaining overall, while commodities are doing their own thing.

No man's land

The biggest problem I see with this chart is that we are essentially and "no man's land." We are halfway between the $96.00 level, and the $90.00 level. In other words, I don't see significant support or resistance at the moment that I feel strongly enough about to play the market. I think that a lot of this choppiness that we're seeing right around the 93 handle is in effect the "middle point" of this larger consolidation region forming. Quite often, you will see the midpoint being an active area for price, as it is "fair value" as far as the market can see. Nonetheless, I think we need to move this market a couple of dollars in one direction or the other before we get some type of playable price action. In the meantime, it should continue to offer decent trading for short-term traders, but you have to be a scalper at best in order to do that.