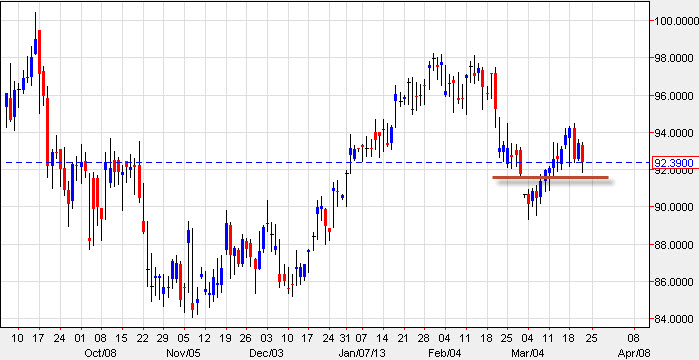

The WTI Crude market fell during the Thursday session, crashing into the $92.00 handle. What's interesting about this spot is that it's the top of the gap that had formed a couple of weeks ago. This means that it should, in theory at least, offer a bit of support. That's exactly what he did during the Thursday session, as you can see we bounced almost $.40 higher. With that being the case, we think that support is trying to build for this market, and if you scan across the chart all the way back to October of 2008, you cannot help but notice that this area has been resistance previously, which means it could be very well supportive now.

I still believe that this market is eventually going to be range bound, but there are a lot of things to worry about between now and then. There is always the risk of headline news coming out of the Middle East that shocks the oil markets, and of course the world economy is something that isn't exactly chugging along in all quarters. Because of this, energy itself could continue to suffer, especially if the US dollar continues to strengthen.

US dollar

Speaking of the US dollar, you will have to watch it if you're trying to trade oil markets. The Federal Reserve is simply pumping far too many of them into the marketplace to think that they will eventually hold their value. In fact, I believe that the price of oil will go on much higher over time, as will everything else. After all, the Federal Reserve seems do nothing but easy monetary policy, and I have a hard time believing that they will be able to "mop up the excess liquidity" when it comes time to.

With this being the case, I still look in the short term as $90.00 being the "floor" in this market, and the $98.00 level being the backside of a $2.00 thick resistance area just above, meaning that the top of this market might very well be "squishy." However, I do believe that buying will serve you well over time.