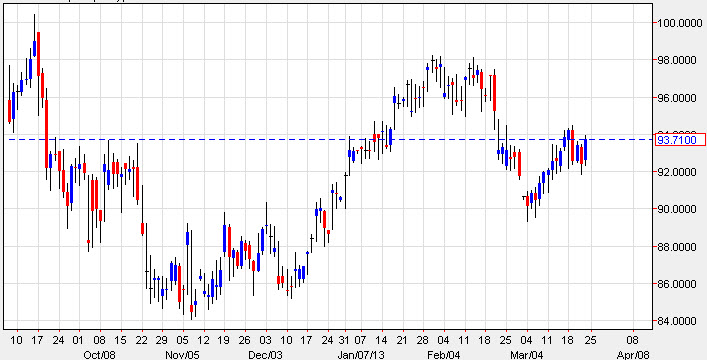

The WTI Crude market had a positive showing on Friday, as we rose above the $93.00 level, and almost reach the $94.00 level. The area that we are currently trading in has been rather consolidative, and as a result the market has been very tight. I personally believe that we are trying to find the "trading range", and that it's very likely to be between the $90.00 level and the $96.00 level. However, that should be amended with the statement that resistance goes all the way up to $98.00, so therefore we could testify as that level.

One of the things we have to keep in mind when looking at this chart is the fact that WTI tends to be used by North Americans. With this being the case, it is more or less a reflection on the economic condition of that continent, and as a result has been doing better than other oil markets such as the Brent contract. With that being the case, it makes sense that we are going up in this market, and falling in many of the other ones.

Employment

One of the indicators you can watch the United States as the employment situation. Because of this, unemployment claims will be important every week, as well as the nonfarm payroll numbers when they come out at the beginning of next month. Employment is one of the main indicators that economists we used to gauge whether or not the economy is picking up, not to mention other things such as GDP and industrial outputs.

As long as the US economy continues to improve, there will be a bit of an underlying bid to this marketplace, and I believe that the $90.00 level will not be broken down below. However, the economy is in moving so strong that a massive breakout should continue. In short, I expect this to be very range bound market, possibly even through the summer so this should become a very nice market to play if you are a short-term trader. Meanwhile, we are trying to set up that range in order to make this a much easier market to be involved in.