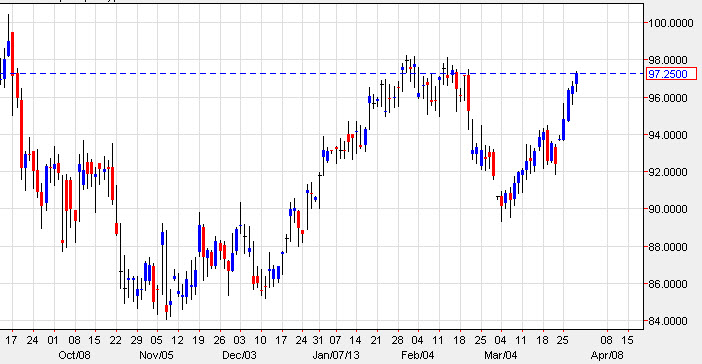

The WTI Crude market initially fell during the session on Thursday, but as you can see we bounced from the lows of the session just above the $96.00 level, and closed at the $97.25 level to form a hammer like candle. This candle sits just below the $98.00 level, which I see as significant resistance. This is the "backend" of a thick resistance level, and as a result I believe that this market could slow down a bit over the next couple of sessions.

There will be limited electronic trading in these markets, and as a result I find it difficult to think that this market will make the breakout in the next session. However, eventually I think we will test this area and decide whether or not we are going to continue higher, or simply defined the spring range. This market likes to trade in ranges, and a range between the $90.00 level and $98.00 level sounds just about average for a trading range in the crude markets.

Can we find enough strength to reach the $100 level?

If we can break above the $90.00 level, I believe that the market will target $100.00 in the near-term. Above there, it is difficult to imagine the market been able to hang onto gains for very long, simply because of the weak economic conditions around the world, and although the US is considered to be one of the better countries right now, it's a real stretch to consider the economy as robust. Because of this, the demand for light sweet crude is in quite as high as a move above $100.00 a barrel would suggest.

Alternately, I do believe that if we see resistance at the $98.00 level form some type of shooting star or another candle of that ilk, we could be looking at an excellent shorting opportunity. As long as we can stay within that level, I believe that we have already found the spring trading range, and a lot of money will be made simply going back and forth over the next couple of months.