The Euro is very likely to continue the week under pressure much like the week before, as the lingering political situation in Italy weighs heavily on it.

Of further concern for the Euro is a European Central Bank that is widely expected to continue along the line of its dovish rate policy at its forthcoming press conference this week. The level of growth has kept falling since the Central Bank’s last meeting though rates are expected to remain untouched. However, the ECB will have to shift its emergency focus to the political gridlock in Italy, in order to prepare for possible financial support where required.

The inconclusive Italian election has once again exposed the underlying threat of Europe’s fragile economy and its attendant risks to fiscal reform efforts. With the present Prime Minister’s supporters earning only about 10% of all votes, it means the next PM will shy away from further implementing the current austerity measures. This is an impending reality for the markets which may return to risk-off mode with a corresponding rise in government debt yields.

The British Pound also recently found itself fighting against negative market sentiment. This was after Moody’s downgraded the country’s Triple-A rating on February 22; saying the UK’s current economic situation will not support a better debt profile. Although other ratings agencies have kept theirs unchanged for now, the downgrade had little effect on UK’s debt yields. The good news for the Pound remains the fact that its government is still committed to its strict austerity measures to enable it balance the budget at the earliest possible time. Also, the £375 billion asset purchase program started in July 2012 will continue at the very cheap rate of 0.50% until serious improvements can be seen.

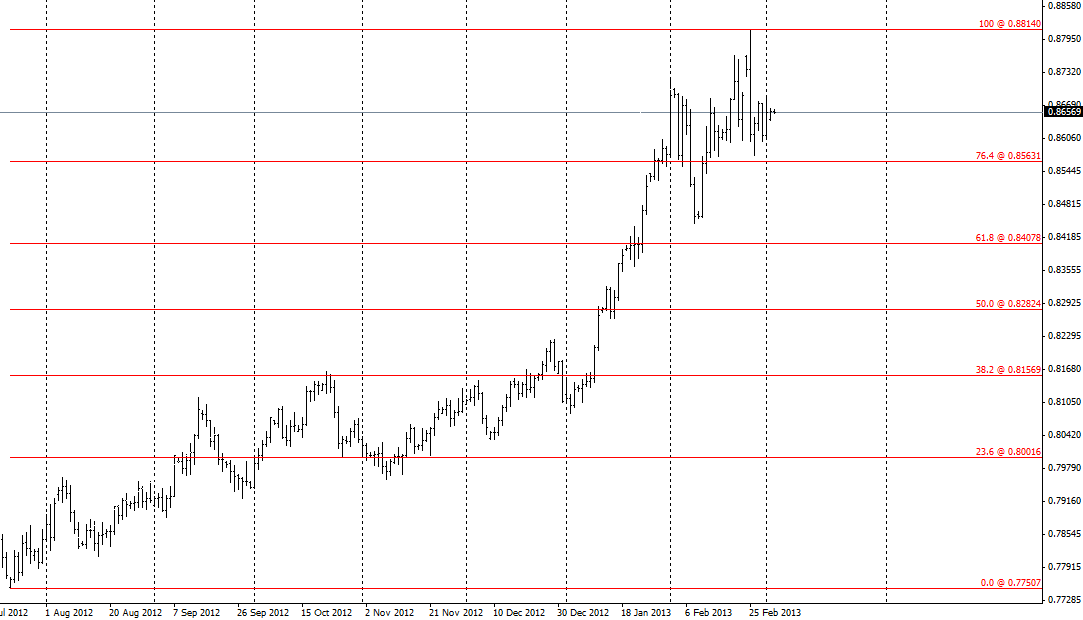

Technically, EURGBP is at oversold levels on higher timeframes and is due for some correction. It will be good to remain on the sidelines for a few more days until a clear top is formed, and a clearer pattern of a retracement emerges.

Monday’s Eurogroup meetings and Tuesday’s ECOFIN meetings are also expected to provide fresh insight into this pair.