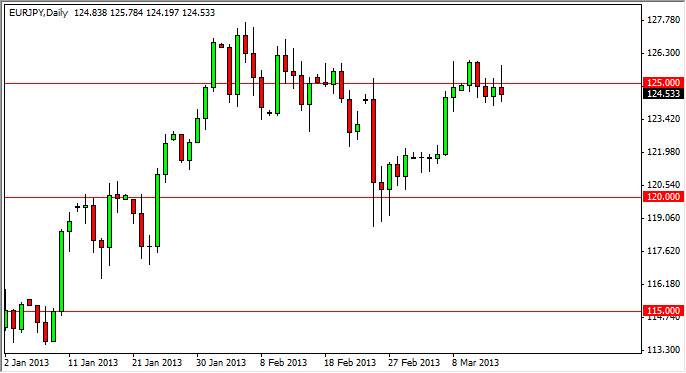

The EUR/JPY pair had an interesting week over the last several sessions, and Friday wasn’t any different. The 125 level acted as resistance as one would expect, but gave the buyers enough trouble to form the shooting star for the day that you see.

The candle of course is bearish, but there are a lot of things out there to consider when it comes to this pair. Although the candle at this level suggests that the market is about to fall, I think this is simply far too bullish of a pair to short. In fact, I think this will end up being a potential buying opportunity. After all, the pair has been in a massive bull market, and I don’t see much changing at this point.

The Italian Parliament is supposed to try and form a coalition government this week, and if they do somehow, this would be wildly bullish for the Euro, and this would send this pair straight up. This would be one of the best pairs to play that move by the way. However, we think that the Italians will eventually have to have another election, so that this drag on the financial markets can continue.

The Bank of Japan

The Bank of Japan continues to work against the Yen, simply jawboning it down at the moment. However, there is a plan forming in Tokyo of massive quantitative easing, and as a result this pair should continue to go higher. The market is a “buy only” markets as far as I see it at the point – no matter how bearish this candle looks.

The 126 level above would also be a sign it’s time to buy, as it would be a break of resistance. However, I think the most likely scenario is that we pullback and form a bit of support at the 122 level. The area would be a decent launching point to continue to buy this pair. This pair will be bullish going forward, and as a result I think buying the dips should work for months, if not years to come.