The EUR/JPY pair rose straight up during the session on Wednesday, as the gap has finally been built from the weekend. This market was moved by rumors during the late hours of American trading that the Bank of Japan was going to announce a larger and sooner than expected asset purchase program as early as today, which of course would help to devalue the Yen even further.

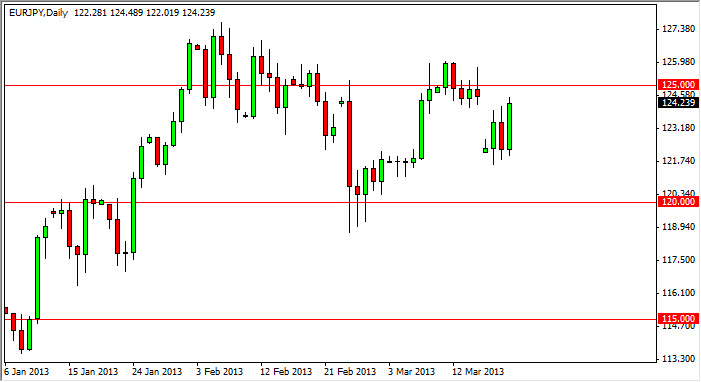

Within this chart, I can see that there is a significant amount resistance at the 125 handle. Looking at this chart, one cannot help but notice that there was a couple of shooting stars formed at the 125 handle, and that the 126 handle was in essence a brick wall. Because of this, I think that the 126 level is the real level that we need to clear in order to send this market much higher. On a move above that level, I would not only be long of this currency pair, but I would then be in the buy-and-hold type of mentality again.

However, it's obvious that it should be significant resistance. This is why I like this trade to the upside if we get it, simply because it would have to do so much to prove itself. On the downside, we can certainly look at this chart and suggest that the 122 level should offer support, as it certainly has over the last several sessions. It is because of this that I think we will eventually breakout to the upside, not to mention the fact that the Bank of Japan would be on your side. However, I am also interested in buying this pair on pullbacks as well. I see absolutely no scenario where we managed to break down through the 120 handle, without at least some type massive melt down in Europe.

Watch Cyprus

One of the biggest problems with going long of this pair is the fact that the European Union has this mess going on it Cyprus. It is because of this that this market could be the most explosive though. If they get something solved in Cyprus, along with the pushing of the Bank of Japan, this market could really take off.