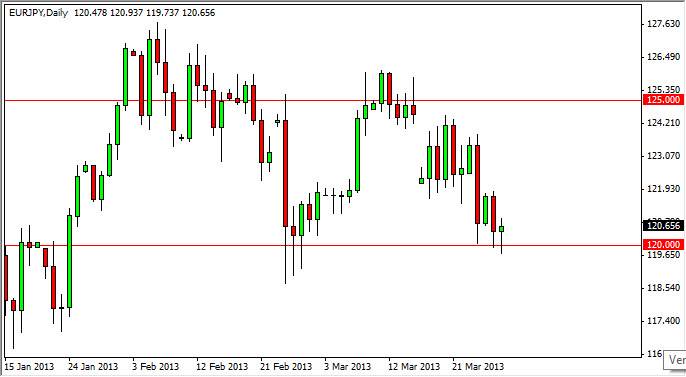

The EUR/JPY pair spent most of the session on Thursday following, but as you can see found quite a bit of support at the 120 handle. This is an area that I've been wanting for quite some time, and it makes sense that we got a bit of a bounce from it. This is an area that saw this on the longer-term charts as well, and because of his a break of the top of the Thursday candle would be a buy signal as far as I'm concerned.

We could go as high as 122 in the short term and 124 the course of several more sessions. At 124, I feel that you begin to see real resistance going all the way 126. Because of this, I would be a bit quicker to take profits at this point time and I also believe that this is simply going to continue to be consolidation. However, there is the possibility of a breakout above the 126 level, and I that point in time I would not only be bullish, I would also be a long-term buy-and-hold type of trader.

European banks versus the Bank of Japan

European banks will continue to plague the Euro over the course of the next few months. However, on the other side of the equation you have the Bank of Japan, which of course is trying to kill the Yen with that being the case, this will be real back and forth type of market in my opinion and a consolidation between 120 and 125 makes a lot of sense.

As far as selling is concerned, I see so much noise and support all the way down the 117.50 that I am not thinking about it. Also, one would have to be very careful going against the Bank of Japan, as if we get some type of breakdown, certainly they will come into the markets and intervene. I believe that there will be a bit of choppy action, but ultimately this pair should in theory go higher over the next few weeks.