Last week’s ECB meeting featured a debate on rate reduction but the Governing Council later decided otherwise. The summary of that meeting as explained by Mario Draghi was that the medium-term economic forecast was stable. Therefore, the Central Bank will leave rates untouched for the foreseeable future. Despite unfavorable economic data in recent times, Draghi believes the Euro area is improving at a steady pace with the medium term inflation outlook still in line with expectations.

He also emphasized on the manner in which the financial markets’ withstood the effect of Italy’s election cliffhanger as a sign of confidence being restored gradually. These short term weaknesses in the ECB’s view are not enough to justify a rate cut. So this should only make the Euro temporarily weak.

Flipped over to the Swedish Krona is a currency which has found itself at an unprecedented strength since August 2012.After Friday’s weaker than expected economic data briefly eased pressure on the SEK, the general downward trend is expected to resume towards last year’s low.

With industrial production dropping by almost 8% during the past twelve months and new orders down by over 5% YoY; EURSEK’s downside risk looks set to continue. Home prices and household lending have placed the country’s Ministry of Finance & FSA on alert, both institutions having earlier indicated that they will do everything to checkmate excessive accumulation of debts. However, Riksbank does not have a history of strong fiscal action in this regard so it’s okay to prepare for more SEK weakness.

In addition to the above, the monetary policy divergence between ECB and Sweden’s Riksbank show evidence of more Krona strength in the coming weeks.

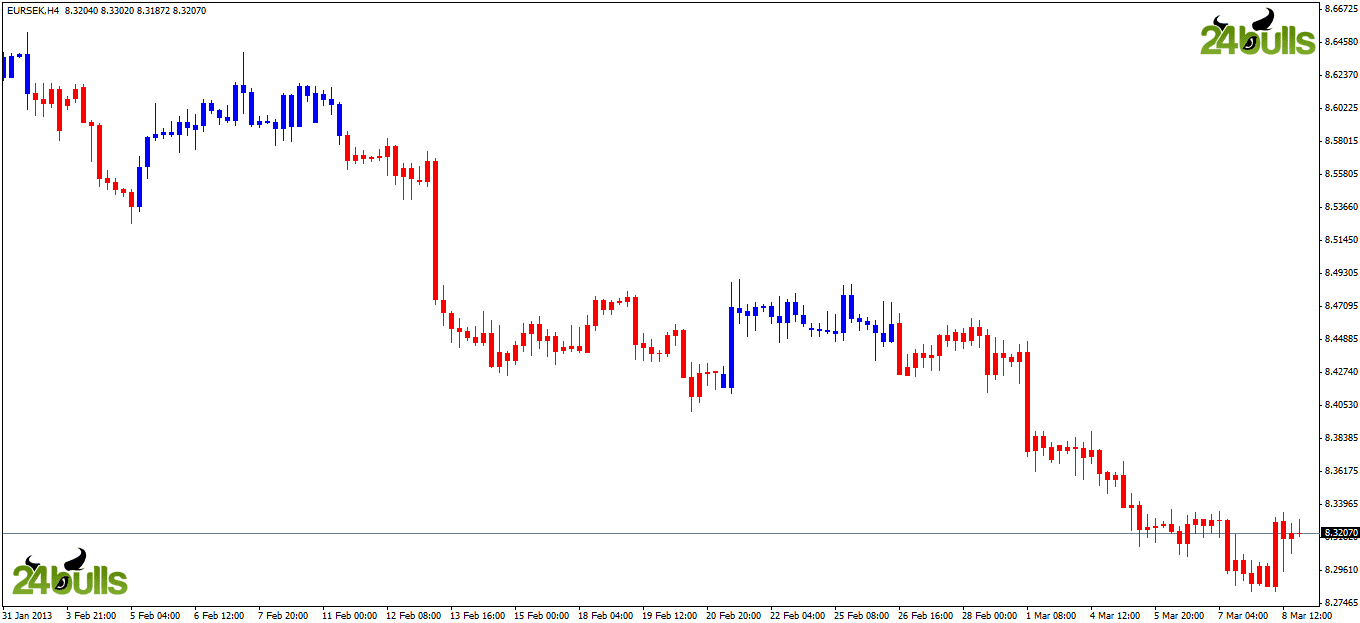

On the 4-hour chart, EURSEK is on a declining path with more ground to cover. Wait for a retracement to 8.3610 to sell targeting 8.2170. A sustained upward break above that threshold will briefly change the outlook for a long towards 8.5050.