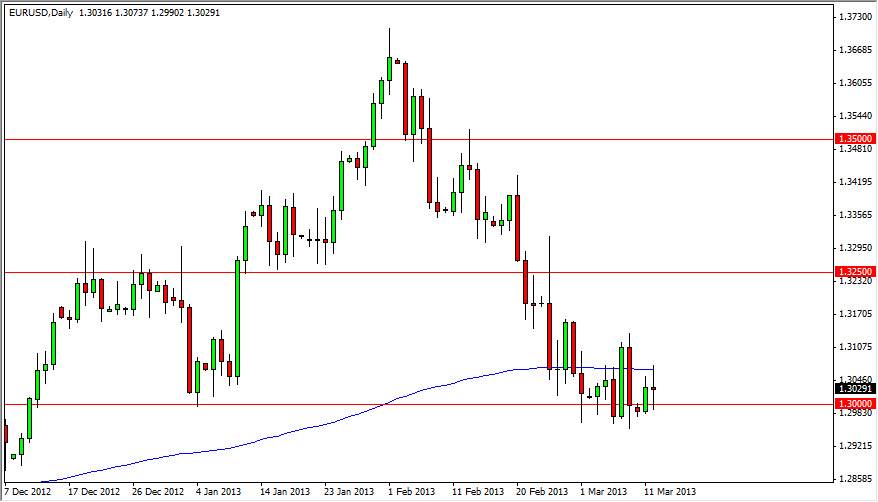

The EUR/USD pair went back and forth during the session on Tuesday, essentially going nowhere. This session simply reinforced the idea that the 1.2950 level will continue to be support, while the 200 day exponential moving average will continue to offer resistance. The candle itself is very neutral, closing just a few pips underneath the opening price. This suggests that we may see a little bit of a choppy sideways trading going forward, and if you think about it does make sense as the Italians will be trying to form a coalition government on Friday, which of course has a pretty significant effect on the Euro.

However, I begin to think about this and wonder whether or not certain eventualities are already priced in the market. For example, I don't think that many people expect the Italians pull some coalition together on Friday, so the downside risk into a negative headline is probably somewhat limited. Backing this idea up is the fact that there is quite a bit of noise between here and 1.28, so moves to the downside will be a little bit restricted anyways.

On the other hand, there is always the chance that there is a surprise. If the Italians get some type of moderate coalition together, I believe that the Euro would skyrocket under those circumstances. In fact, I believe the entire market off guard, and send this market much higher.

Sideways

Looking at the 200 day moving average, you can see that it has flattened out over the last two weeks. This suggests to me that this market isn't ready to make any serious moves yet, and we may simply have to churn in this neighborhood. I believe that going long of this pair is going to be the more difficult trade, but it may very well be the correct one. Nonetheless, I see the 1.3250 level as being crucial for anybody willing to be bullish of the Euro. For myself, a daily close above that level would give me enough confidence to start buying again, just as a daily close below the 1.2950 level would be enough to get me to start selling again. In the meantime, I believe there are much easier trades out there.