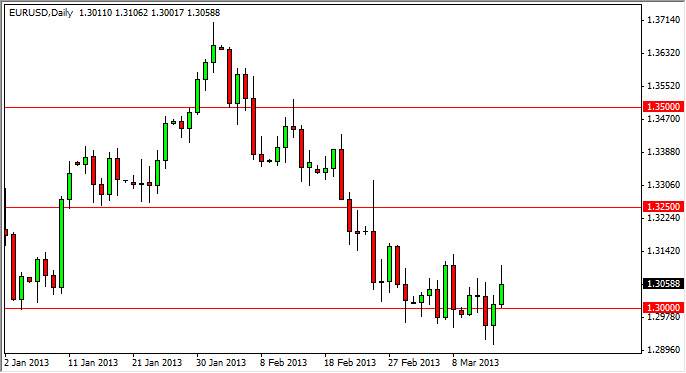

The EUR/USD pair had a positive session on Friday, as the 1.30 level continued to offer support. The market has been attracted to this level more than once, and the idea that this market could continue to consolidate around this area is no real stretch of imagination.

The candle shape is a bit of a shooting star, and as a result it looks as if the 1.3150 level should offer resistance in the near-term. The bottom is held up by the 1.28 level below, and because of this I think this pair will continue to be a short-term trader’s kind of market. This market should continue to be one that we will have to trade on a short-term chart, and taking profits quickly.

The proceeding candle to the Friday session was a hammer, so this suggests that we will continue to see consolidation for a while. The area down to the 1.28 level is very clogged with noise, and as a result this pair will struggle to gain traction until we get some kind of catalyst to move this market.

Catalysts?

One of the biggest catalysts for this pair to move this week will be the Italian Parliament. They are trying to come together and form a coalition government, in order to move forward. If not, they will have another election, which of course is the expected result. If the Italians do come together, this market could take off suddenly – ignoring a lot of resistance.

However, there is also the FMOC meeting this week, and there is a chance that the statement on Wednesday could move the markets. Essentially, anything that even suggests that the Federal Reserve is coming close to cutting off some of the easy monetary policy, we could see a strong move to the US dollar. This would not only move this pair lower, but would move the US dollar higher against almost everything. With that being the case, we don’t expect anything like this, and because of this I think that this market will continue to be choppy over the next several sessions.