The EUR/USD pair fell during the session on Thursday, which of course would have been a surprise as there are so many things going on in Europe that make most people nervous. The situation in Cyprus remains murky, and there are a lot of concerns about the banking system in that small Mediterranean country. There are a lot of other banks in Europe that are exposed to this mess, so while the markets seemed to take it in somewhat of a calm manner, one cannot help but think that there are many more repercussions if things go bad.

While nobody was looking, it turns out that the Italians still have no governing coalition. It is because of this that I feel that the Euro is going to continue to suffer in the near-term. After all, if we got a solution to the Cypriot problem, we would probably get a knee-jerk reaction. However, I believe that that will simply be an opportunity to start selling this pair again, as it couldn't take too awfully long for the market start focusing on the dealings in Rome.

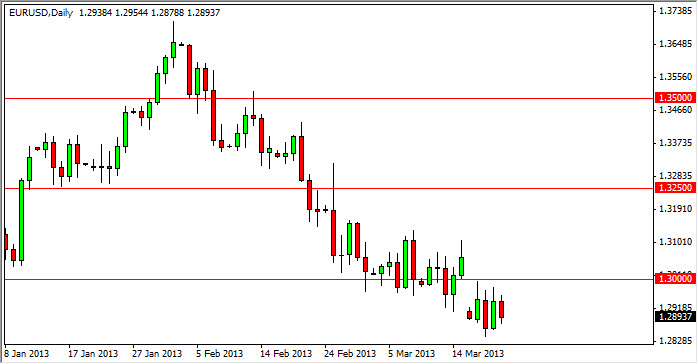

1.3250

The 1.3250 level is my high watermark for bearishness. In other words, I need to see the market still above this level in order to change my opinion on the Euro. This is because there are so many problems in the European Union right now; it's going to be difficult to get a lot of confidence in the currency. Confidence is what will be needed to drive this market higher. Until we get back, this market will essentially be a "sell on the rallies" type of market.

I think that there is a ton of support at the 1.28 handle though. Because of this, I almost am hoping for a rally just so I can sell it. If we can get under the 1.28 handle, I think this pair could go much lower. In the meantime though, it looks like we’re going to have a rally behavior, with a negative bias in this market. Going forward, I can't imagine a situation where I would want to hold the Euro for any length of time.