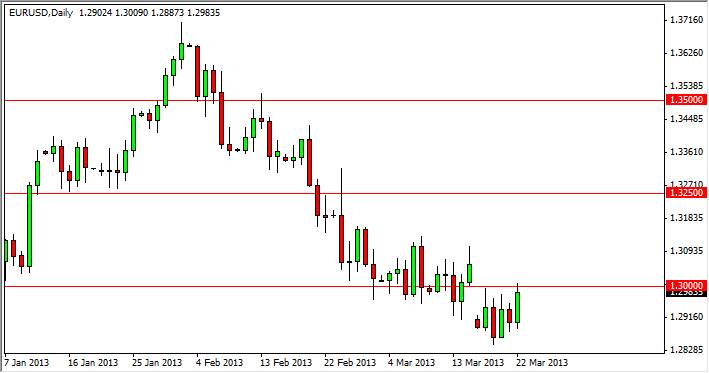

The EUR/USD pair rose during the session on Friday, but stopped at the 1.30 level yet again. This level has acted as significant resistance lately, and this is accentuated by the gap that had formed at the open of the week. However, the gap has real potential being broken at the open on Monday, because of the news coming out of Nicosia. It appears that the Parliament in Cyprus has enacted new laws that will make accepting the EU bailout much easier, and has removed many of the barriers that the markets were worried about.

With that being said, the Italian situation has not been addressed. There is no coalition for the government, and as such there are still concerns about the mass amount of anti-austerity candidates that were voted into Parliament just a few weeks ago. There is a lot of uncertainty in Italy, so I think that any knee-jerk reaction on Monday will eventually be faded. After all, the Italian situation have the markets relatively freaked out to begin with, and Cyprus was just simply the icing on the cake.

1.3250

For me, I believe that the market needs to break above the 1.3250 level in order to become bullish again. I see far too much noise between here and there to get caught up on a bullish run, only to be taken out by a few bad headlines. There are massive potentials for bad headlines out there, and as a result this pair will be difficult to trade. I still believe that there is enough bad news waiting to come out that selling rallies will be the way to go.

Furthermore, it may just be simpler to avoid the Euro altogether. There are other currency pairs out there after all, and with a lot less drama. However, it's very likely that we will see quite a bit of volatility over the next several weeks why the world worries about various issues in places like Italy, Cyprus, and whether or not there is such thing as Chinese growth these days. With that being said, the US dollar will more than likely continue to be favored over the longer term.