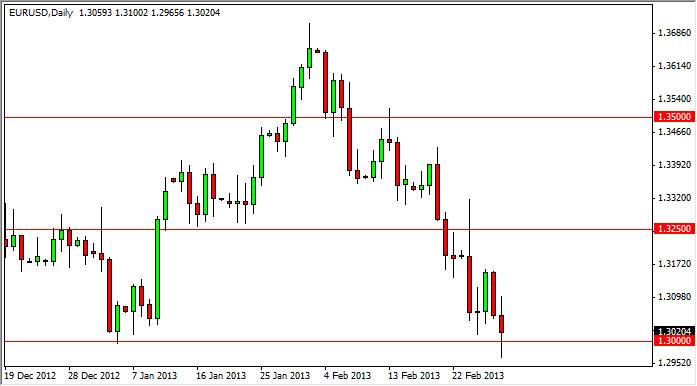

The EUR/USD pair had another negative session on Friday, and even managed to break down below the 1.3000 handle. However, you can see that this market did provide some support in the general vicinity and we popped back over the 1.3000 handle by the time the close came.

The chart does look extraordinarily weak, but on the longer-term charts you can see that there is a lot of noise below the 1.3000 level, and as a result the easiest pips selling this market have already been had. In fact, I believe that a bounce could very well be coming, and this is predicated upon not only this chart, but the fact that the Euro looks like it's about the bounce against a couple other currencies as well.

Any ballots will more than likely end up being a selling opportunity in the long run, but I can deftly see that there would be a bit of a reprieve as the Euro is probably oversold at this point. This doesn't mean that I necessarily want to go along of this pair, as I see better opportunities out there, but the truth is that selling at this point is going to be almost impossible as there is so much noise below. Him

Italy, it's all about Italy at the moment.

It would be interesting to see how this next week plays out. While we do have nonfarm payroll numbers coming out on Friday, the entire world will still be focused on Italy and whatever happens with the elections. After all, we basically have a "hung Parliament" in Rome at the moment, and nobody seems willing to work together. If that's the case, there will be no coalition and there very well could be another round of elections. This of course would throw more uncertainty into the mix, and the market absolutely hates that. There are a lot of people in Italian politics right now that look like they're likely to be very anti-Euro, and that of course has the market completely spooked. With that being the case, as long as we don't get any massive headlines out of Europe, and more specifically Italy, I believe a bounce can happen. However, like I said I believe it's a short-term opportunity. If we can get above the top of the Friday candle, we could retest the 1.3250 level.