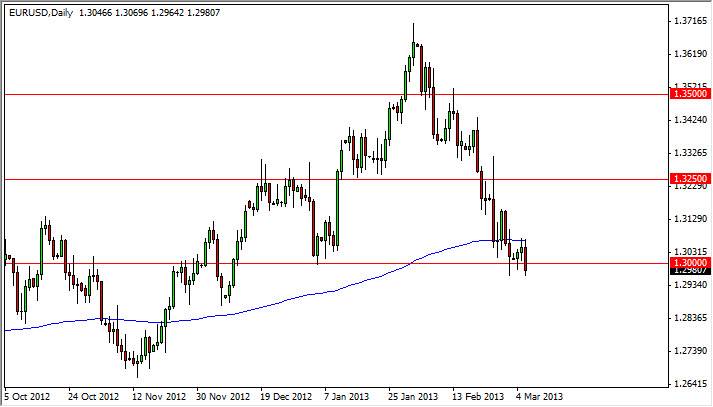

The EUR/USD pair had a negative session on Wednesday, as a close below the 1.30 level for the first time. It has fell below that level previously, but never close therefore the session, a small but crucial difference. Looking at this chart, it's obvious that the Euro is out-of-favor, and the blue line represents the 200 day exponential moving average. As you can see we are just below that, and have certainly changed trend according to basic technical analysis.

Going forward, there are a lot of different catalysts the dips in this currency even lower. However, there is quite a bit of noise below, and I think the 1.29 level is roughly where it finally ends. In other words, the next 100 pips lower are going to be much harder to get than the previous couple of hundred.

The European Central Bank will have something to say later today and as a result the results of the meeting will be scrutinized. The question is what they will do in order to deal with weak exports, which in a world where you devalue the currency you help some economies, while punishing others. It is because of this that the ECB has one of the most difficult jobs in the world, leaving alone the whole problem with Italy at the moment.

Selling rallies

And by far, I believe the easiest way to trade this market is to simply sell rallies. Down where we are currently, there is a real danger of support coming into play, and push the pair back up. Granted, it would more than likely just be it "dead cat bounce", but nonetheless it could be painful. Is because of this that I am hesitant to put a large position on at the moment.

The 200 day exponential moving average is fairly important though. There are a lot of trend traders the pay attention to, and will be bailing out of long Euro positions at this point. However, it must be said that those traders have been beaten up fairly significantly over the last several years in this particular pair, leading me to believe that there aren't as many of them out there these days.