By: Johnathan Miller

The situation in Cyprus has risk-assets spiraling as we await the outcome of the vote this afternoon. The move to shutter banks until Thursday isn’t stoking any further confidence in the Euro at the moment as the unprecedented move to tax depositors may set a very negative tone for European banks. The risks in Cyprus however are dwarfed by the size and scale of the problems in both Spain and Italy.

Spain is still grappling with an unresolved corruption scandal that could threaten the present government while Italy still has no formal government. Another vote in Italy might see further gains for anti-establishment parties. The nonperforming loans on the books in these respective countries are several orders of magnitude larger than tiny little Cyprus, but this might be the black swan event that causes a cascade lower in Eurozone assets as confidence and sentiment shift.

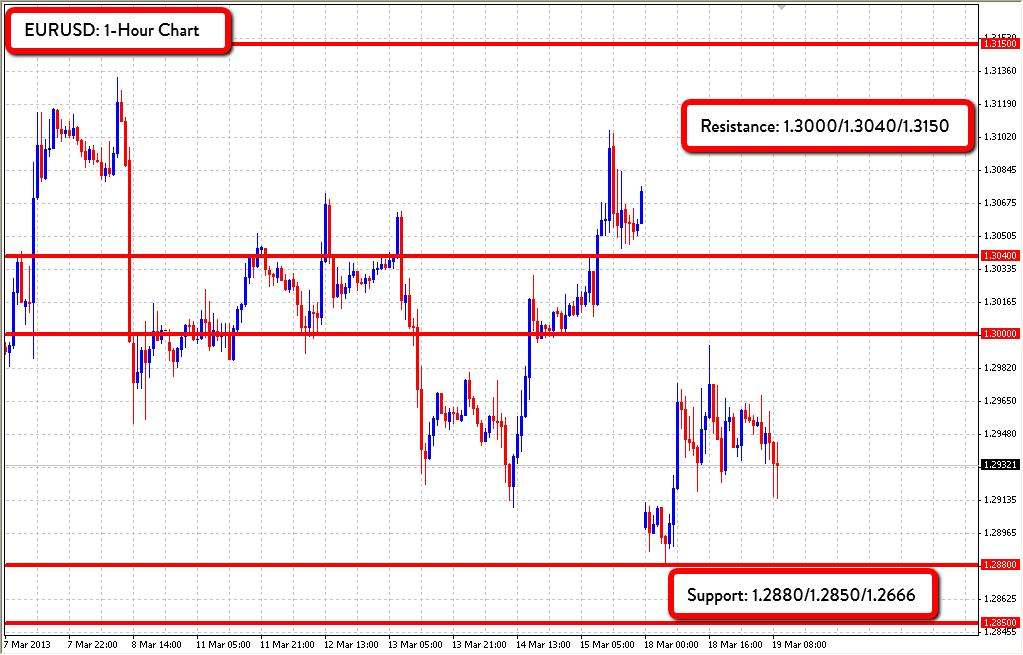

EUR/USD has remained mostly range-bound since its weekend reopening as large offers sit at the 1.30 handle with the pair trending in the downward channel started at the end of January. From a technical basis, the 200-day moving average is sitting around 1.2873 and a move below that level could signal downside until 1.2666. Near-term support is at the most recent low of 1.2880 and then 1.2850 on a longer-term basis. From an upside perspective, if the pair manages to overcome the 1.30 level, the next resistance level is at 1.3040 before the pair could see upside as high as the longer-term major technical level at 1.3150. Today’s decision will fundamentally alter the state of the economic union so watch carefully for vote outcome as the implications for EURUSD will be far reaching.